Business Model Leverage

Spotify, the audio market, and the negative churn Consumer SaaS company.

What I didn’t know when we launched to consumers in 2008 was that audio — not just music — would be the future of Spotify.

-Daniel Ek

One of the first business axioms I remember learning is that it is cheaper to keep an existing customer than it is to acquire a new one. In an era defined by unlimited consumer choice and dynamic consumer preference, this statement rings truer than ever.

If retention is the currency of this new consumer era, the companies that outperform over the next decade will be the ones who invest that scarce resource to feed a flywheel of growth that favors deeper customer relationships over more relationships.

Until recently, high churn in the consumer subscription market has been seen as unavoidable, with expansion opportunities limited and competing alternatives plentiful.

This is starting to change.

Today's consumer subscription leaders are aggressively expanding the definition of what it means to serve their customers — Peloton's lofty vision in its S-1 and Daniel Ek's reframing of Spotify as an all-encompassing audio platform are the two most notable examples.

As these strategies develop, I expect that the growth metrics underlying the most successful Consumer SaaS companies will come to resemble those of the most successful Enterprise SaaS companies — specifically, a material portion of growth for the outperformers will be attributed to negative churn.

But, like with any revenue, not all negative churn is created equal. What we are really looking for in trying to identify the future outperformers is what I call Business Model Leverage.

A company has Business Model leverage when — after reaching some degree of scale — its core business sets it up extremely well to grow into higher gross margin adjacencies with market opportunities large enough to meaningfully impact the broader business.

Using this definition, Spotify, with its singular position in the exploding audio market and a highly attractive (and climbable) growth ladder sitting before it has the opportunity to become the gold standard for how to scale a sustainably profitable and efficient consumer subscription company.

Negative Churn and Consumer SaaS

Negative churn has long been a powerful growth mechanism for enterprise SaaS companies, creating something akin to a high yield savings account — with limited additional effort or cost, more money comes in every month.

Most digital consumer subscription companies, by contrast, have historically spent more time and money finding new customers than they have driving additional revenue from existing ones. This is starting to change as the market matures and consumer willingness to spend expands at a rapid clip.

In the Enterprise world, the paths to negative churn have long been well understood. First, built a great product (or create sufficient switching costs) so customers don't leave and then add seats, drive additional resource utilization, or cross-sell other adjacent products.

Negative churn in Consumer SaaS will be driven by the same factors, but with slightly different flavors. Using Spotify as the example, these expansion categories look like:

Seat Expansion — Generally limited in the Consumer SaaS context but for Spotify, this is Family and Student plans.

Resource Expansion ("Mix”) — In Spotify's case, resource "expansion" (i.e. listening to more music) is good as a way to drive engagement and reduce overall churn, but resource-related negative churn is largely driven by a shift in "resource mix" (i.e. streaming other audio categories)

Cross-sell — Adding new products or new features for which customers will pay more.

While Spotify has successfully leveraged Family and Student plans ("Seat Expansion") to drive growth and reduce churn, it is the latter two categories that separate the company from Consumer SaaS peers and give the company true Business Model Leverage.

Business Model Leverage and the Gross Margin Flywheel

The ear is clearly under-monetized vs. the eye. Daniel Ek has made it no secret that Spotify aspires to be the world's premier audio company — Audio First — going well beyond music streaming to close this 10x revenue gap.

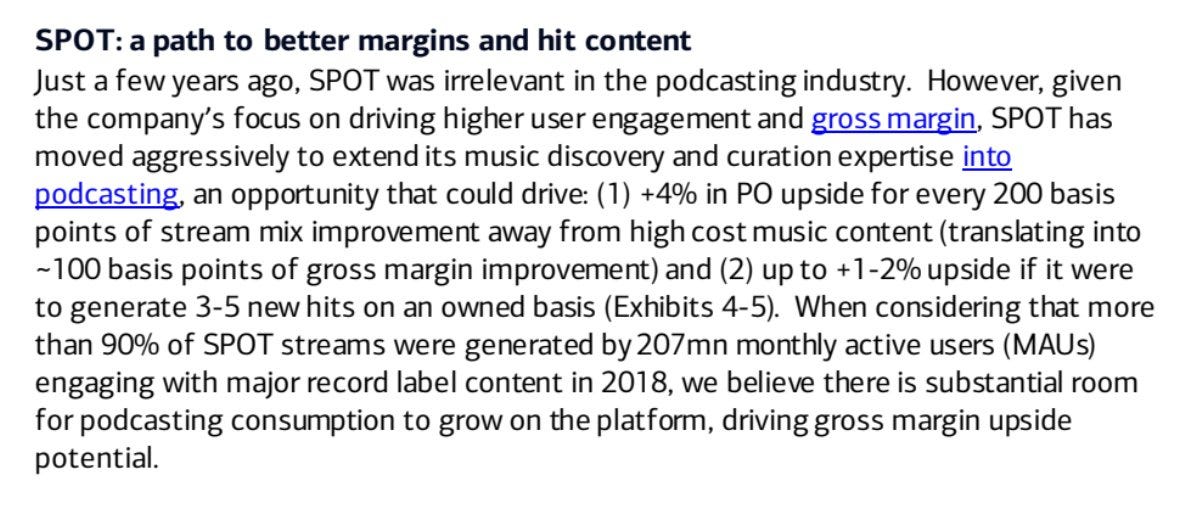

The first step they have taken in closing this monetization gap has, famously, been podcasts, which allow the company to move away from paying music rights holders on a marginal cost basis, shifting either to free content or exclusive. Stratechery (of course!) has a great explainer of how this impacts the broader Spotify business.

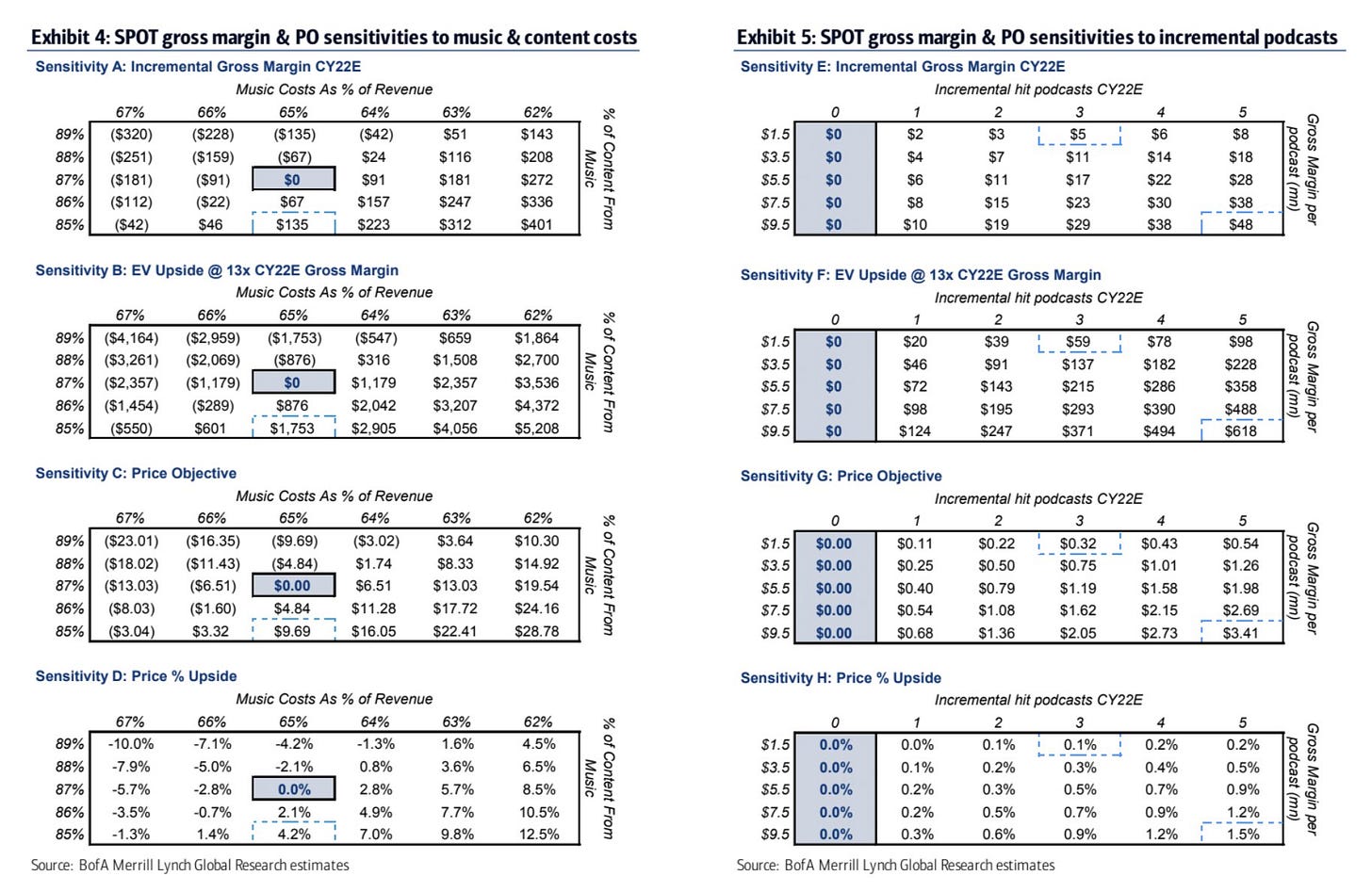

As we've seen the company's podcast strategy post Gimlet and Anchor acquisitions take shape, we can start to more accurately model how this "Resource Mix" shift will impact the business long term. And per research from BofA Merrill Lynch Global Research, the impact will be significant (if you follow me on Twitter and send me a DM, I’ll send you the report 😉)

Podcasts, however, are simply the next step in Spotify's Gross Margin Flywheel, as driving more people to spoken word content leverages unlocks interesting emergent platform effects that wholly sets the company apart.

As audio categories continue to blend — podcasts, books, education, wellness, religion — Spotify is upstream (data-wise) of a lot of compelling consumer subscription expansion opportunities it can capture via M&A, internal new product development, and an expanded platform approach platform to close audio’s engagement/revenue gap.

This upstream data advantage paired with the enablement of an ecosystem of products in the market reacting to and creating new consumer behaviors around audio consumption fully distinguishes Spotify from its peers.

Cross-sell for a company like Peloton might mean selling (lower margin) apparel or in-person boutique classes at one of their locations.

For Spotify, it means taking existing customer purchasing behavior around content like meditation or audiobooks and bringing that natively into the place where a user already gets their music and podcasts. Again, they may do this through M&A or by building their own products, quickly gaining distribution though their existing customer base and likely providing the same offering for a lower cost than competitors in the market.

The Path Forward: Going Long(tail)

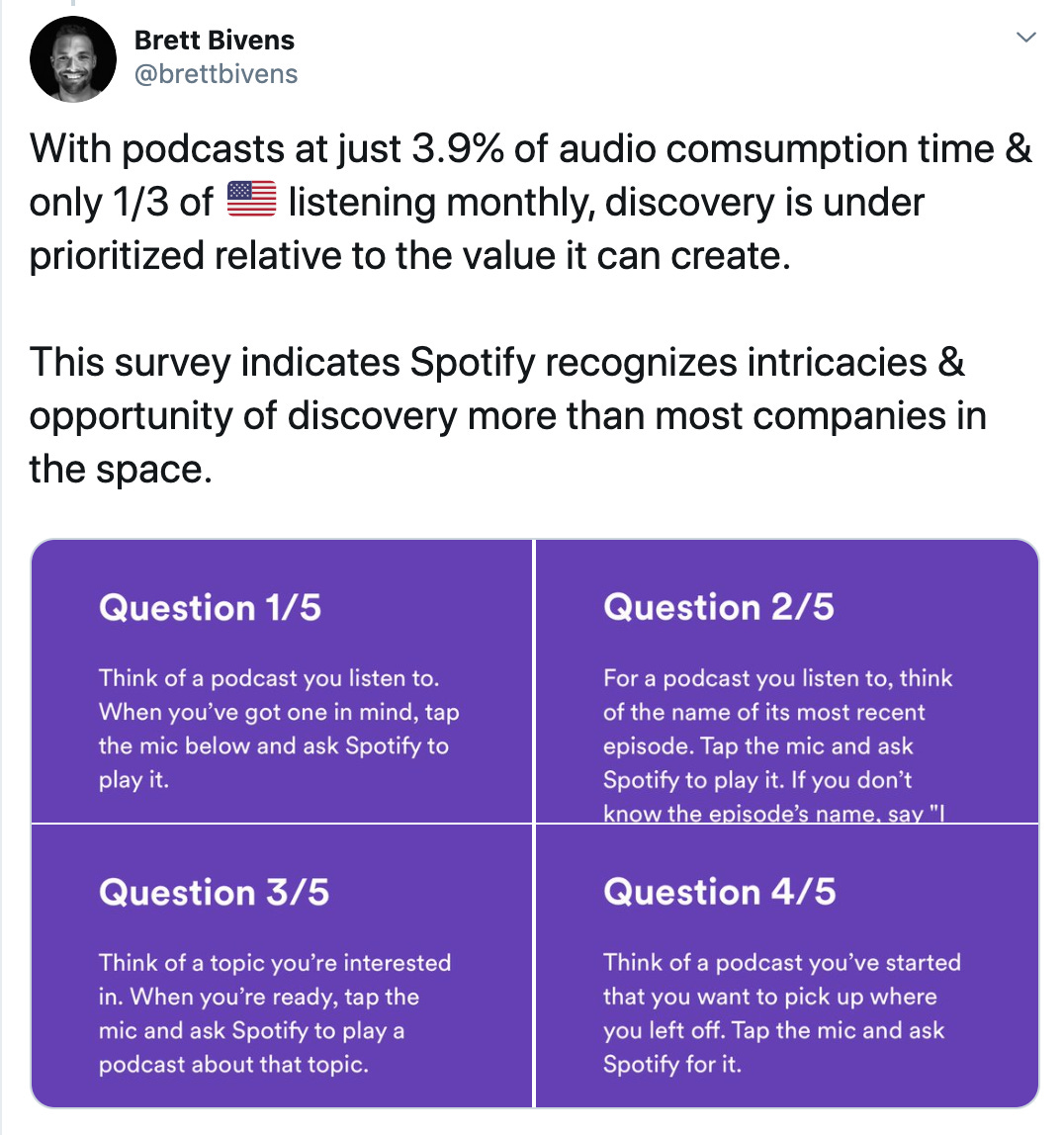

In music, Spotify has (relative to peers), nailed discovery. Podcast and Spoken Word discovery is, unquestionably, a different beast, which Spotify seems to understand and is taking steps to grasp consumer behavior in this area.

As spoken word discovery gets more sophisticated Spotify can go extremely vertical with its offerings and even begin looking at ways to add interactivity to spoken word similar to its background music videos or its lyrics integration with Genius — again via M&A, partnership, or internal development.

If Spotify does get more aggressive expanding to different audio categories, it would be natural for founders and investors active in the space to get concerned — we certainly have portfolio companies that would "compete" with these expanded offerings.

I, however, am optimistic that the company's maneuvers will actually expand the market by accelerating consumer awareness of new forms of audio content, creating opportunities for startups to offer a better vertical product for a core base of obsessed users to begin building their own Gross Margin Flywheel.

At TechNexus, the firm where I am an investor, we love consumer subscription businesses as well as anything audio-related. If you are building something in the space or know someone who it, please get in touch! And if you have any friends or colleagues interested in the topics I cover, please forward this email along!