Internet Escape Velocity

How companies can break free from Google and Facebook to own their own demand

The first lecture in an Internet Economics 101 course might start off something like this:

The internet economy is defined by increasing returns to scale. Winners take a larger market share in the online world than the offline world because zero marginal cost distribution and diminished transaction costs make it possible for companies offering a better user experience to insert themselves between a supplier and a customer, re-directing the flow of power in a value chain. Over time, companies who own consumer demand at scale become difficult to displace or get around as network effects and data advantages compound.

Syllabus material for Internet Economics 101 would draw heavily on the thinking of people like W. Brian Arthur and Ben Thompson and would feature posts like this one from Gavin Baker that looks at internet economics from the investor perspective:

Scale and loyalty are generally the most important metrics to me as an investor as they are the most sustainable — and measurable — competitive advantages. They are much more important online than offline, which is why the internet economy has such pronounced “winner take most” dynamics relative to the offline economy. Barriers to entry on the internet are low, but barriers to scale are high.

If scale and loyalty are the defining characteristics of successful consumer internet companies, it begs a set of follow up questions — what strategies can companies employ to build the loyalty that enables scale, and how can those companies continue to scale without diminishing the user experience that is fundamental in creating loyalty in the first place?

Put differently, how can companies hit escape velocity from the pseudo-government level control Google and Facebook exert over the internet economy?

Companies that chase scale at the expense of customer loyalty end up as commoditized suppliers who see their numbers go up and to the right until an algorithm tweak in the wrong direction sends them on a “pivot to video”-like death spiral.

And most companies with loyalty end up failing to find paths to scale that they can execute on without sacrificing margins, experience control, and eventually, direct relationships with their customers or users.

Achieving escape velocity — turning intense loyalty into the type of customer-aligned scale that compounds a company’s advantages — is rare and requires simultaneous execution across three core business inputs that together create a virtuous cycle of sustainable, platform independent growth.

The Reassurance Multiple

Responsive Instrumentation

Business Model Leverage

To explore these three factors further, we will look at the trajectory of Lululemon, where the digital business grew 41% year over year and accounted for a third to top line revenue in the recent quarter. In contrast to many peers, namely Under Armour, the company’s omnichannel success has positioned it to break free of the “CAC is the new rent” paradigm imposed by the giant internet platforms.

If there are any companies you think are on the verge of hitting Internet Escape Velocity, I’d love to discuss them with you here in this thread on Twitter.

1. The Reassurance Multiple

“Perhaps what people are seeking when they go to the doctor is not treatment but reassurance." - Rory Sutherland, Alchemy

You can estimate a company's "Reassurance Multiple" — the way users perceive the brand and experience as well as the depth of their loyalty — by mapping its strength across six core factors against competitors.

Loyalty factors like community, personal and social transformation, purpose finding, creativity, and accountability then flow through to business outcomes like word of mouth growth, retention, repurchase rate, and upsell, tying directly to how much it costs companies to acquire new customers and how valuable those customers are to them over time.

The apparel market provides a great example of how these factors flow through to profitable, sustainable growth.

The level of reassurance a company provides its customers serves as a base upon which it can start to think about achieving scale. But a company’s ability to offer a high degree reassurance — and thus acquire customers inexpensively and keep them engaged for the long term — runs deeper than what the customer sees.

2. Responsive Tooling

When behavior shifts radically, companies with “responsive instrumentation” can adjust incentives and distribution models in real-time to deliver on brand promises.

It goes without saying that no event in recent history has shifted behavior as radically as the pandemic we are currently weathering. This, in turn, has laid bare which companies truly possess the ability to rapidly reconfigure operations on a global scale to retain trust and even strengthen customer affinity.

Lululemon, it will come as no surprise, has proven its adaptability in recent months. The idea of responsive instrumentation runs far deeper than just what the consumer sees — it is more than a mobile app or a credible eCommerce presence. It stems from company culture and is deeply embedded in the way a company operates day to day.

For example, Lululemon’s vertically integrated approach enables real-time global inventory visibility and gives them the unique ability to repurpose stores as fully controlled eCommerce distributions centers.

“We're less dependent on the need to flush out inventory. With our technology and the use of RFID, we can access product at any point across our network, not just DCs, but at our stores as well from ship from store. Online, our plan is to turn on ship from store from our stores, although they will not be open to the public.”

Additionally, the company’s ongoing focus on the needs and shifting demands of its community — the aforementioned factors driving a high Reassurance Multiple — led them to invest well in advance of the pandemic in relationships with leading digital companies like Mirror (US - investment) and Keep (China - partnership) that have paved the way for the company’s nimble shift to a more aggressive digital content strategy while its ability to offer in person experiences remains limited.

Taken together, Lululemon’s adaptability has played a major role in its performance relative to peers like Nike, Adidas, and Under Armour since the beginning of the year. Also worth noting is the way this stock chart ties to the strength of each company’s Reassurance Multiple.

This unique bundle of advantages — from a narrowed product focus to digital touchpoints to control of distribution — forms Lululemon’s Innovation Stack:

When competitors attempt to copy features that disruptive companies introduce, they may miss the importance of the Innovation Stack upon which the feature is built. A single feature is almost impossible to copy, turning the Innovation Stack into a major competitive advantage. According to McKelvey, companies built on Innovation Stacks tend to navigate crises better than others because they are used to solving problems in the face of significant competitive pressure and considerable uncertainty.

Competitors — incumbent and emerging — can try to copy individual elements of what Lululemon has built but fail to pull the whole picture together.

3. Business Model Leverage

Everything Lululemon does — from vertical integration to the way it trains employees — is geared at excelling in areas of the business that drive best in class loyalty.

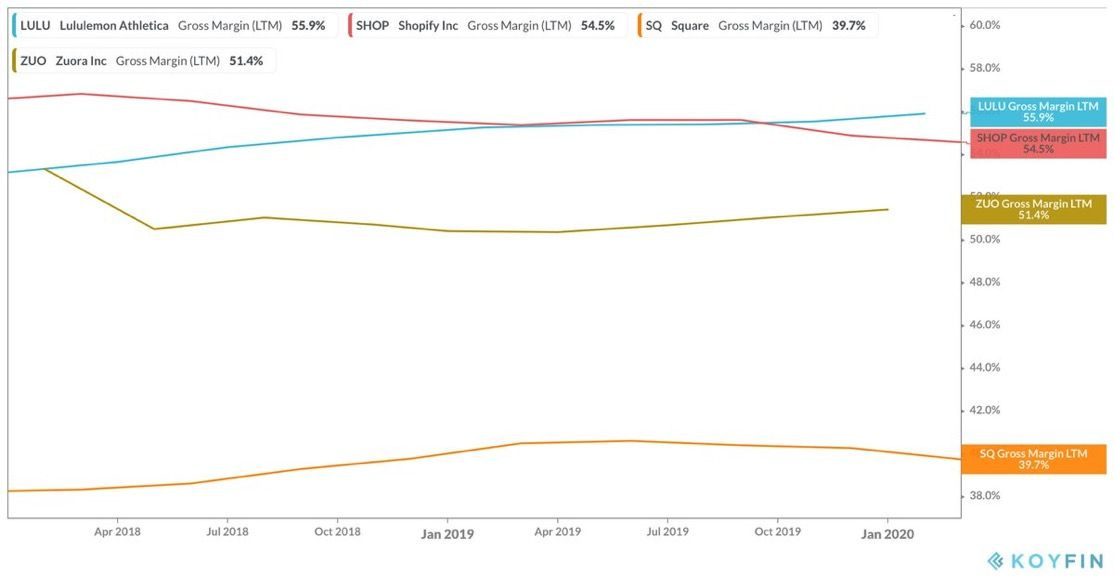

That, in turn, gives the company almost tech-like Gross Margins (higher than Shopify, Peloton, Square, Zuora as well as its peers).

But while loyalty is necessary to hit internet escape velocity, it is not sufficient — companies must also find ways to scale that loyalty. This generally means expanding the elevated user experience provided by the company’s core offering that serves to create its own form of a network effect and becomes untouchable by internet aggregators like Google and Facebook.

A company capable of making this leap has Business Model Leverage, a concept I wrote about last year:

A company has Business Model leverage when — after reaching some degree of scale — its core business sets it up extremely well to grow into high margin adjacencies with market opportunities large enough to meaningfully impact the broader business.

Business Model Leverage is present when a company is capable of building on top of its existing strength to launch significant new markets, products, and distribution strategies that actually increase loyalty — allowing for continued investment into responsive instrumentation (including advantaged AI/ML capabilities made possible by scale) and feeding back positive to compound the strength of the company’s “owned network”.

To illustrate this concept, we can look at Under Armour, a company that has made almost the exact opposite choice from Lululemon at every stage of the decision tree. From 2PM ($):

The Baltimore, Maryland brand built a brand around the idea of channel inclusivity. The model was a proverbial shotgun spray of dueling demographics, varied price points (premium vs. bargain), disheveled distribution models, and inconsistent messaging. Plank believed, at perhaps the worst time to do so in recent history, that by positioning his brand to exist in every nook and cranny of sports and performance, the sum of all parts could eventually equal a greater whole. He was wrong.

In return for this lack of focus and a commitment to growth in the absence of loyalty, the company and its shareholders have paid a steep price. While Lululemon shares have grown 264% (as of the time of writing) since 2017, Under Armour has shed 69% of its value.

The dance required to reach internet escape velocity is a delicate one.

Seek scale in advance of or without considering the impact to customer loyalty and end up a commoditized supplier who can only grow by paying an increasingly uneconomic Aggregator Tax. Over-index on loyalty with a core initial customer segment and lose new opportunities to more aggressive competitors.

The select few that break away do so by operating from day one with customer centricity, breeding intense loyalty that unlocks customer-aligned opportunities for scale and kicks off a flywheel of compounding advantage.

If you enjoyed this post, I’d love to have you share it. If you hated it, come tell me why I’m wrong on Twitter. 😀

This is really well done. Thanks for putting this together!