“Few copywriters share my appetite for research. The late and great Bill Bernbach, among many others, thought that it inhibited creativity. My experience has been the opposite.”

- David Ogilvy, Ogilvy on Advertising

The fate of a venture capital firm hinges on its decision quality and its impact on companies.

Unique access to an emerging class of entrepreneurs is often the wedge that helps a firm build early momentum. But a well-tuned decision-making engine and the ability to create value are the foundational factors in maintaining that proprietary access and establishing a reputation that positions a firm to win fiercely contested deals. These are the drivers of persistent performance.

Effective research frequently finds itself directly upstream of this sustained success.

Why does research matter now?

"Financial capital can successfully invest in a firm without much knowledge of what it does or how it does it. Its main question is potential profitability, sometimes even just the perception others may have about it. For production capital, knowledge about product, process, and markets is the very foundation of potential success."

- Carlota Perez, Technological Revolutions and Financial Capital

The value of research was easy to diminish in the previous decade as momentum-based models – fed by the promise of boundless new software market opportunities and a laissez-faire regulatory environment – became the dominant venture investment strategy. But that approach has hit a wall.

This paradigm shift, the Perezian transition from a market dominated by speculative “financial capital” to one led by strategic “production capital” is evident in a range of signals, qualitative and quantitative – moderated growth forecasts for public software companies, increasing caution from LPs in continuing to underwrite emerging momentum-era venture firms, and a palpable macro-driven vibe shift towards physical world transformation. Evidence of this market recalibration even shows up in the revised Union Square Ventures thesis.

As technology is increasingly put to work to transform existing industries, investors must evolve. To grasp the inherent complexity of this new paradigm – deeply embedded incentive structures, complex value chains, regulatory constraints, different financing needs, and blended talent pools – context is king.

Effective venture research is the engine for generating high signal, previously scarce context amidst complexity.

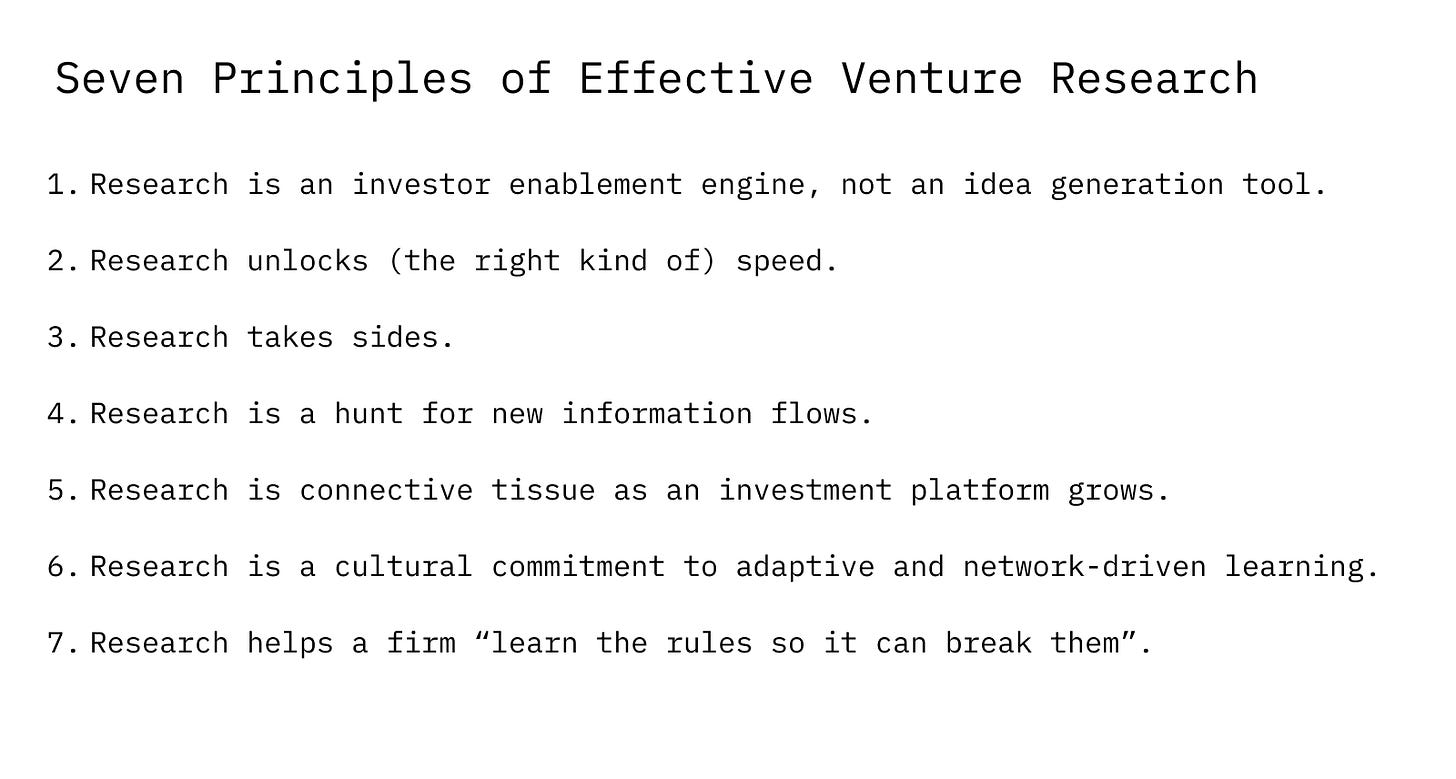

Seven Principles of Venture Research

Much like the platform model pioneered by the likes of First Round and a16z, a firm’s research function should be viewed as a product – a strategic asset designed to systematically unlock i) higher-quality investment decision-making and ii) more productive and proactive engagement with portfolio companies.

The principles laid out below –contrary to the title, these are principles rather than miracles (inputs rather than outputs) – help build a foundation for this product-centric approach to venture research, helping us understand “what great looks like” by highlighting core jobs to be done.

Principle #1 → Research is an investor enablement engine, not an idea generation tool. Venture capital is a field-based business, won by firms with a strong ground game capable of uncovering the “secrets” possessed by exceptional founders. The role of research is thus not to develop new ideas (the job of the entrepreneur) but to enhance investor perceptiveness to these new ideas and create a process to help other team members rapidly develop the right context on a given opportunity in order to serve as valuable through partners during a decision process.

Principle #2 → Research unlocks (the right kind of) speed. For the better part of a decade, venture investors focused on the wrong kind of speed. Instead of building the intellectual foundations for informed decisiveness (prepared minds), investors with no structural edge adopted speed to decision (i.e. FOMO) as a north star metric. Effective research enables substantive speed. By helping accelerate understanding of a market opportunity or technology, research helps investors engage in more productive dialogue with founders earlier in the relationship (faster time to trust and value add) and creates a compounding network of experts that can be engaged to increase speed to insight.

Principle #3 → Research takes sides. The best research crafts a story. The best stories have stakes, heroes and villains, winners and losers. Stories need not come at the expense of rigor and detail. The best stories are rich in detail, the best storytellers meticulous. Research is not a simple presentation of facts, no good story is. The best research conveys what we need to believe, why we should believe it, and why that matters. Morgan Housel says that the best stories – especially ones dealing with complex topics – are like leverage. Research is about creating leverage for the investors at a firm and for the companies it works with.

Principle #4 → Research is a hunt for new information flows. In my 15 years of listening to podcasts – and a lifetime of reading books – perhaps no line has stuck with me more strongly than this from Charlie Songhurst: Trying to be smarter than other people is very hard and it doesn't work very often. Trying to have an insight that you get because you sit in a different information flow just seems exponentially easier. Like stories, new information flows are like leverage. The information flows cultivated through venture research directly reflect a firm’s “taste” or “style” in the problems it seeks to understand and opportunities it seeks to exploit.

Principle #5 → Research is connective tissue as an investment platform grows. As a firm scales, information silos and misalignment threaten success. While research doesn’t outright solve these problems, effective information synthesis and sharing across investors, teams, and strategies help foster the trust and context necessary to unlock the full weight of a firm’s capabilities in service of better decision-making and support of portfolio companies.

Principle #6 → Research is a cultural commitment to adaptive and network-driven learning. The best investors are learning machines. The best investment organizations are as well. Effective research embeds an intentional culture of curiosity inside an investment organization by creating intellectual breadcrumbs charting the evolution of a firm’s (and individual investor’s) point of view and its decisions, deepening self-awareness. Additionally, the artifacts developed through research – especially when shared publicly – increase surface area and engage the broader ecosystem to increase the pace of learning and engage a diverse set of perspectives not found in-house.

Principle #7 → Research helps a firm “learn the rules so it can break them”. Early-stage venture capital is a business of exceptions. The best founders and n-of-1 companies tend to break established patterns and ways of thinking. As such, an overreliance on abstractions – mental models and investment frameworks – can be detrimental to the objective function of a venture firm: back outlier founders and companies. But research – good research – is not about abstractions. It is about posing the questions, often simple questions, that catalyze an effort to uncover the ground truth.

One way to think about venture research is as a form of “steel manning” the status quo (existing economic ecosystems, technology paradigms, and intellectual leanings) to understand when a founder and a moment in time break established patterns. Research then arms an investor with the context (yes, that word again) to help that founder and their team capitalize on what makes them unique by effectively positioning themselves relative to that marketplace of incumbents.

Venture research is not about building the best market map. It is not, to return to David Ogilvy, a tool to feed confirmation bias, used as a drunkard uses a lamppost – not for illumination but for support.

Research, when done well, is not a hindrance to the creativity needed to succeed as an early-stage investor, but a constraint that focuses creativity on the most important things.

Love this, resonates a lot