Spotify: The Ambient Media Company

The new era of "passive media", Spotify's Ladder, and combating commoditization.

The rise of AirPods, smart speakers, and other wearable devices may not signal the onset of a true platform shift, but it undoubtedly represents a transformational evolution in the way we will consume media — and this emerging paradigm of distributed, "eyes up" device interaction directly benefits audio more than other content categories.

As you read through the post, I’d love to discuss this post with you on Twitter — disagreements, other ideas this prompts for, etc. Also, don’t be shy about throwing a like or a retweet my way ;-)

When the iPod gave way to the iPhone in the early part of the last decade, audio quickly took a backseat to video and gaming as the favored format for mobile media consumption and the dominance of those two categories shows no sign of slowing down — both will continue to consume an increasing share of our "engaged" attention and can be expected to monetize accordingly.

But for the first time since iPod sales began a downward trajectory in 2009, the consumer devices reaching scale today are largely audio-first and elevate the medium in a way that will unlock previously unforeseen use cases and business models and send the category on a growth trajectory in line with its more popular peers.

The "audio day", as SiriusXM's Greg Maffei likes to call it, seems to be at an important inflection point with competition in all parts of the market growing more intense — from devices to music streaming to new audio-first content categories — as companies see a massive opportunity to close the monetization gap and capture a larger share of our daily "passive" attention.

And while we may still be in the early days of audio's growth trajectory, the scale of the opportunity at hand — the possibility of addressing a market size of "all daily passive time" — means that it is no longer enough for companies to think in terms of increasing their share of the consumer's audio day.

The real winner in audio over the next 10 years will also need to own an outsize share of something much larger — the consumer's ambient hours.

In Real Life Magazine, Drew Austin (who writes one of my favorite newsletters) provided a nuanced and balanced look at how this audio-first future, powered by augmented reality devices like AirPods, will look and feel as it increases the number of ambient hours in each of our days:

As audio-based platforms take off, network effects would kick in, strengthening the incentives to leave earbuds in for longer and longer. It wouldn’t seem rude to wear them in conversation; it would be as acceptable as glancing at one’s phone or even sending a quick text message seems today. Just as people began to set their phones on the dinner table and direct a small percentage of visual attention toward them, so we might learn to split off a small, continuous share of auditory attention for the headphones we leave in — a rebalancing of sensory inputs to expand our sonic world beyond the merely local.

At first glance, it would seem that companies like Apple, Amazon, and Google — who can all be credited to various degrees with catalyzing the growth of audio in recent years — are well positioned to build upon their hardware efforts to win in software-centric parts of this emerging space. And all are certainly making significant efforts to that end, as we will discuss later.

Yet despite the built-in advantages of these platform players, I believe it is actually Spotify who is best positioned to ladder up and capture the value that comes from being the market's predominant ambient media company.

Before diving into what Spotify's growth ladder looks like and why they are uniquely positioned to take that path, it is worth quickly level setting on how they got to this point in the first place.

Combatting Commoditization

What is, perhaps, most interesting about the growth opportunities Spotify has going forward is that they are largely a function of the company being backed into a strategic corner as a result of a disadvantaged core business model.

Today, a majority of Spotify's revenue is tied to music streaming, where they pay music rights holders on a marginal cost basis with each incremental stream and incur additional costs as consumption increases.

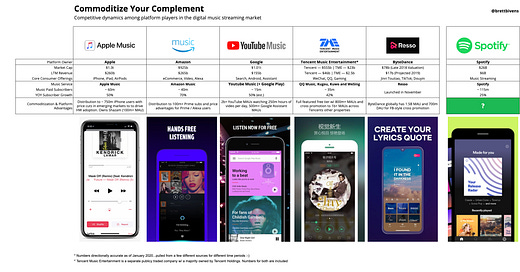

Scale solves some of the issues related to this — but getting to requisite music streaming scale in the face of competition from platform players like Apple, Amazon, Google, Tencent, and Bytedance is likely an insurmountable hurdle. All of these companies can afford to engage in price cutting and are happy to run their music businesses unprofitably for a long time to support larger and more attractive core businesses (AirPods, TikTok, etc.).

In short, these companies see their digital music businesses as a complement to their primary raison d'être and are aggressively seeking to commoditize it. Despite the scale of their investments in the space, winning on the content and streaming side of the audio market will always remain a nice to have (to varying degrees) for these platform players. For Spotify, it is existential.

To Spotify's credit, they identified areas of business model leverage — starting, famously, with Podcasting — well before it was too late and have rapidly aligned resources to combat commoditization and start an aggressive push to move beyond music.

Gimlet, Anchor, and The Ringer

Thanks to acquisitions of Gimlet Media, Anchor, and Parcast as well as the launch of streaming ad insertion technology, Spotify dominated the conversation around Podcasting in 2019. And for the most part, early results backed up the hype.

In Q3 2019, the company's numbers indicated the investment in shifting their "resource mix" was paying off — podcast adoption had reached almost 14% of MAUs and quarter over quarter growth in podcast hours streamed was almost 39%.

As the company's strategy has come into clearer view in recent periods, we can start to more accurately model how this "Resource Mix" shift away from music streaming will impact the business long term. Per analysis from BofA Merrill Lynch Global Research, the potential is significant.

But as I detailed in my post on the company's business model leverage, podcasts should be viewed as just the beginning of a much longer term strategy around audio-first content and the recent news of the company's "early" acquisition discussions with The Ringer hint at a much bigger vision for the future of Spotify than most give them credit for — and is one of the reasons I'm very optimistic long term on the company's prospects.

Spotify's Ladder

Forgive me for borrowing a Stratechery analysis format here but what are we Substack newsletter writers if not a bunch of Ben Thompson cosplayers?

It should come as no surprise that Spotify — a company with over 4,000 employees in dozens of offices around the world — has so ably navigated the shift to "audio first" over the course of the last year.

The company's history is one full of similarly decisive moves in the face of significant existential threats. The boldness to launch a music streaming service in the mid-2000's — facing down the piracy-created consumer expectation of free music on one side and a record industry fighting for its life on the other — was the first of many similarly bold decisions that the company has become culturally accustomed to making.

Rung 1: Discovery

Apple launched Apple Music in June of 2015. The next month, Spotify launched Discover Weekly. Within a year, Discover Weekly had grown to 40 million users by delivering a differentiated experience that masterfully balanced data driven personalization with human curation.

From Ben Popper's deep dive in The Verge about one year after the launch:

Until Discover Weekly launched this past July, no major streaming service had tried to combine a static playlist with personalized recommendation that fit a single user. There have been individually personalized streams, like Rdio’s You.fm, and plenty of static playlists created by humans. Apple Music and Amazon Prime, for instance, broadly target playlists to users based on the artists and albums they play, but you and I won’t receive different versions of Apple’s "Hip-Hop Essentials" based on our taste in rap or our listening history.

The reason no one attempted something like Discover Weekly until now is because a static, personalized playlist is very risky. A radio stream usually begins with a prompt from the user and can adjust in real time based on a user’s feedback. Discover Weekly, by contrast, is two hours of music you get once a week with no real explanation of why you’re getting these tracks, or how to influence that process. Just like handing a mix tape to your crush in real life, once you finalize the playlist, you’re committed. Somehow Spotify’s algorithms manage to deliver me a consistently great experience.

To this day, personalization and discovery remain the core differentiators between Spotify and its music streaming competitors and an "asset that doesn't earn" that drives retention in the near term and conveys pricing power in the long term.

Rung 2: Vertical Depth

The three remaining rungs on Spotify's ladder — all of which are works in progress — build off of the idea that Spotify's long term success hinges on differentiated discovery. This is why I consider the initial "horizontal" push into podcasting through acquisitions of Gimlet Media and Anchor more a necessary re-enforcement of the company's foundation than a rung unto itself.

There are certainly similarities between music discovery and podcast discovery, but for the most part the two are different beasts and, at least at the outset, require a different approach, which Hot Pod's Nicholas Quah touches on here:

In my mind, the playlist construct assumes the episode is the atomic unit of content, and it’ll be interesting to see how Spotify grapples with differences between ongoing programs, a serialized limited-run series, and something weirder like a week-long Dan Carlin episode. It’s one thing to curate music playlists, in which most of the units are approximately the same length, but it’s another to curate a broad universe of spoken audio things altogether.

These taxonomy challenges coupled with what I would wager is a lower level of "listening diversity" in podcasting than in music (i.e. the number of artists listened to on a regular basis for podcast listeners is lower than for music listeners) may mean that a more human-centric curation process is most effective in the near term.

This is why a potential acquisition of The Ringer is so interesting to me. By bringing the team from The Ringer in house, Spotify is not just buying a horizontal podcast production company. It is buying a deep understanding — from production to talent to business — of what the core user in two key verticals (Sports and Pop Culture) wants out of the content they consume, regardless of whether that content is text, video, or audio.

Reaching the point where spoken word discovery can be scaled in the same way audio discovery has been will require a holistic, talent-led approach that favors unscalable experimentation (ex. content lengths, series structure, etc.) that doesn't scale and that can only be done by "category native" teams.

Rung 3: Expanded Formats

If a concerted effort to more deeply develop specific podcast categories gets Spotify closer to the core user, expanding formats gives them the opportunity to continue making those core users more profitable by shifting the revenue mix even further in the direction of fixed cost (or zero cost) content while also creating revenue growth opportunities through additional advertising and subscription expansion.

Again, The Ringer is an interesting addition here because of their history of innovating in audio-first formats. The Book of Basketball 2.0, NBA Desktop, and the company's commitment to documentary filmmaking all represent new and potentially interactive content formats that blend the ways we currently think about audio.

And the opportunities for expansion don't stop there. Formats like education and wellness are also well suited to layer on to existing offerings and CEO Daniel Ek recently spoke about the company's expansion into kids programming as well as the potential for expansion into corporate-focused content on the Invest Like the Best Podcast.

In the context of ambient media, "Spotify Experiences" (not a real thing, yet 😊) would be another compelling path that would move us closer to heads-up discovery by leveraging the always in nature of devices like AirPods along with geolocation to power audio-first experiences in the real world.

The Final Rung: Social

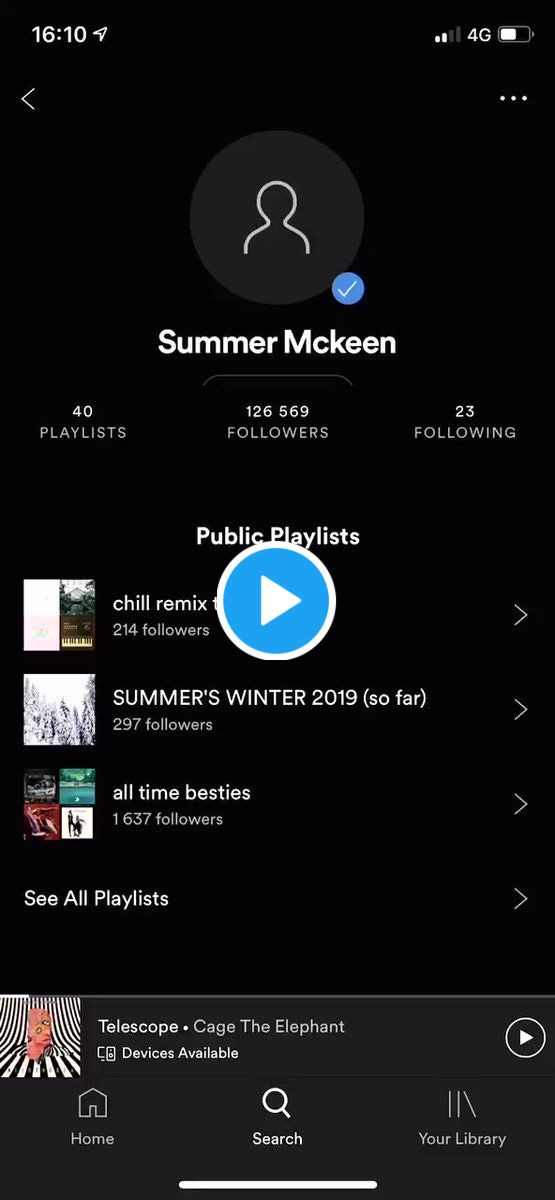

One area where Spotify has made limited progress over recent years is with its social strategy. The company's de-prioritization of this area can be seen both in its product, where the "social feed" remains the primary way users engage with one another, as well as in its M&A strategy, as Cherie Hu points out in her highly recommended piece on Spotify's future:

There are real structural justifications for Spotify slow playing the social opportunity — as Victor Patru noted, adding too many social features would risk undermining the company's bargaining power with record labels.

But if Spotify is able to successfully scale rungs 2 and 3 of the ladder to meaningfully and permanently shift its "resource mix" away from music streaming, the label bargaining power question becomes less significant and frees the company to move aggressively into deeper on-platform social experiences.

Aggressiveness will be important in this case because, if history is to be believed, winning audio will be dependent on winning social audio.

This conversation and the importance of social to the future of Spotify and to audio more broadly led me to speculate a bit on something that had been on my mind.

And while I'm not convinced this specific M&A scenario would actually be good for either company, I do believe Spotify's move into social needs to be on the same order of boldness.

Losing social to current US competitors like Apple, Amazon, or Google doesn't seem a significant threat, but Chinese competitors like ByteDance (Resso) and Tencent (QQ Music, Kugou, Kuwo and WeSing) are taking a social-first approach to music and presenting yet another existential challenge for Spotify. They may not enter Spotify's core US market aggressively near term term (though it can't be ruled out) but they are competing more directly in a number of important international geographies.

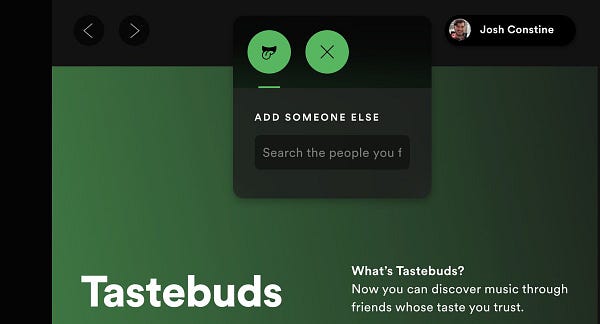

Recently, we've seen Spotify kick off few interesting and potentially significant experiments in social — Tastebuds and Stories, which are both centered around music.

Spotify Tastebuds

Spotify Influencer Stories

But it is clear the company will need to do more and, to continue on one of the primary themes of ths post, it will need to figure out how to crack social beyond just music.

Here, the recently IPO'd Lizhi — China's largest UGC audio community and its largest "interactive audio entertainment" platform — can be instructive and offers a few interesting angles worth exploring for Spotify.

The company is small relative to others we've discussed (~ $500m market cap) but has a diverse business, with a platform that features 7 different social-centric content formats, including audio-based games and audio live streaming.

Interactive live streaming, in particular, represents a highly attractive opportunity for Spotify as they look to develop a social strategy that both pulls attention away from (among other things) terrestrial radio and allows them to scale into lines of business with attractive economics. From the Lizhi's IPO filing:

The biggest challenge for Spotify in social isn't whether there is a compelling strategy to pursue. There are quite a few that seem plausible.

Again, success in social will lie in Spotify's ability to follow a product strategy that leverages the embedded strength they have developed in discovery to further differentiate the way they help users find and share elevated audio experiences.

Reaching the top of this ladder — becoming the company that owns our collective ambient hours in the same way Netflix and Fortnite have staked claims to a significant portion of our stationary attention — is, of course not guaranteed.

A competition slide featuring three of the world's four largest companies (with perhaps the most significant structural advantages of any incumbents since the days of the Robber Barons) as well as two of the most innovative and aggressive large companies on the planet (Tencent and ByteDance) should leave no doubt as to what Spotify is up against.

But the ambient media revolution remains early days, as does the vision Spotify has for how large it can become.

We believe the market that we're going after is going to be at least a billion, probably two or three billion people around the world. And if we are going to win that market, I think we'd have to be at least a third of that market. So we're talking about somewhere between 10x - 15x of opportunity left.

The battle for sustained success in the ambient media landscape will come down, in many ways, to balance. Balancing long term vision with the ability to react nimbly to near term developments. Balancing the need to address users at scale with the importance of the human element in creation and curation. And, for many companies, balancing commitment and investment to audio with broader business initiatives.

On all three counts, Spotify comes out ahead.

The company has proven the resiliency of its culture multiple times by responding to existential competitive threats with elevated product experiences and showing an incredibly clear understanding of what it will take to succeed across multiple time horizons. And there is no question, Spotify is all in on audio.

This clarity of focus and cultural alignment are unique among competitors and will play a vital role in helping Spotify become the predominant company in the age of ambient media.

I’d love to hear what you thought and discuss Spotify’s role in them media landscape with you on Twitter.