The Business Equation

Feeding the accumulating advantage flywheel

In assessing the strategy that has allowed Benchmark to remain at the top of the of the venture capital industry for two decades, I laid out three core pillars that guide the way the firm operates.

Founder-led Insight — Benchmark is allergic to trends, top-down thinking & thesis-driven process.

Early "Liquidity Quality" — High engagement, repeat usage, profitable unit economics. Depth > breadth.

Increasing Returns Flywheel — Plugging high early engagement into a business model that allows it to compound and generate more success.

A three step process to drive sustained advantage in an industry as competitive as venture capital is, of course, a simplification of the myriad factors that must be taken into account in order to keep an edge.

Simplification is, however, a powerful weapon in complex environments. To paraphrase Occam's Razor, simpler solutions are generally better than more complex ones and can help us hone in on what really matters by blocking out the noise and more effectively capturing the underlying structure of a given situation.

In effect, this three step process is Benchmark's business equation — a simplified set of factors that the firm's partners use day to day to guide decision making.

As you continue reading through the post, I’d love to discuss with you here in this thread on Twitter — disagreements, other ideas this prompts for you, etc.

The Business Equation

Every business, as Keith Rabois of Founders Fund is fond of saying, can be distilled into a simple equation.

And as we move from observing a 5-person investment firm like Benchmark to looking at the levers that drive complex companies like PayPal or Peloton — with faster feedback loops, more operational data, and a far greater number of people who need to walk around with the core business equation in their head every day — the recipe necessarily gets more quantitative. This doesn't, however, mean it should get more complicated.

A good business equation meets three straightforward criteria:

It focuses on isolating controllable high-leverage inputs

It is deeply tied to value delivery (user engagement)

It maps directly to a company's accumulating advantage

A company that incorporates these three factors into its business equation has a higher likelihood of creating sustainable alignment of purpose and more effectively allocating resources to drive outperformance over the long term.

It will likely come as no surprise that Amazon is among the best in the world at building and executing on a business equation that incorporates these three criteria. From the company's 2009 Annual Letter to Shareholders:

Optimizing for inputs is central, as is the company's trademark customer centricity which hits on both the idea of value delivery and is core to the company's advantage flywheel.

via FutureBlind

It does, however, feel like a bit of a cop out to simply point to Amazon for anything strategy-related and say "be more like them". 😀

So to explore the idea further, we will look at a few other business equation examples through the lens of each of the core criteria teased above.

1. Business equations aim to isolate high-leverage inputs

My first explicit introduction to the idea of business equations came from Harrison Metal's Michael Dearing in his essay and video about the applicability of Drake's Equation — an algorithm developed in the 1960's to describe the number of detectable intelligent civilizations in the Milky Way — to business management.

Specifically, Dearing's analysis explored how a set of variables could be chained together (and weighted) to help break down complex questions into more comprehensible components and how he and his colleagues utilized the construct at eBay:

The thinking behind Drake’s Equation gave me and my fellow general managers at eBay a common way to describe our revenue. eBay revenue = gross merchandise sales x our take rate. Gross merchandise sales was just the number of listings x the fraction that were successful x the average selling price (ASP) of the items. You could refactor the equation to look at active buyers, active sellers, or a combination. The point is that all of us — whether in engineering, marketing, trust and safety — could understand the variables that drove business results.

Quick aside: The Harrison Metal Library is one of my favorite places to pass time on the internet

As you can see from the eBay example (eBay revenue = gross merchandise sales * take rate), the highest level business equation for any company is rarely all that novel and may in fact seem obvious for people already well versed in whatever the given company's business model is.

The critical piece, as Michael notes in his essay, is how effective a company is at empowering more executives and teams within the organization with the necessary "tools" to go deeper than that high level equation and find their way down through the metric maze to layers two and three and then grasp how those more granular metrics roll up into the broader outputs.

In a podcast interview with Village Global's Erik Torenberg, Keith Rabois expanded on this idea, specifically highlighting the value (and scarcity) of executives who have the ability to see not only the broader equation, but also the relationships between each of the variables (and their sub-variables) to create differential impact on the company:

Let's try a simplified equation to start in which there are three variables. What tends to happen is that different parts of the company will optimize one of the variables, and that doesn't necessarily lead to the best ultimate outcome. So the important thing for an executive, the more senior they are, is to understand the trade offs or the relationship between variable A, B, and C, because sometimes the net output — which is what you really care about — may be compromised by maximizing one of the variables as opposed to the other one.

And where this is very actionable as an executive is when you hit resistance on tweaking one of the variables. The really strong executives and founders and CEOs know that they're hitting sort of disproportionate resistance and rather than fighting uphill on this one variable, they realize that they can tweak a different variable and that again, the multiplication will net out to be the same or better. And so that requires thorough understanding of the relationship and the weighting of the different variables, as well as having proficiency (and this is the hardest part) across those dimensions.

So for example, let's put some labels. Let's say one variable is sales, one variable is marketing, one variables is product, and add another layer, one variable might be pricing. Unless you're actually competent at all four of those disciplines, knowing which one to tweak and how much you can tweak it and where the leverage is like, is almost an incompetent decision without having significant expertise in each. So it's very difficult to find executives for that broad, but where you see the breath of understanding they actually have a natural feel.

Ro — DTC Metrics Explained

The best example I’ve seen of a company that has invested in helping the entire organization internalize all of the variables of its business equation is Ro, who published a must-read deep dive on DTC metrics that creates a navigable map walking the reader through an all-encompassing "metrics journey" — from the highest level outputs down to individual-contributor level inputs, highlighting various trade-offs and interaction points along the way.

I highly recommend reading the piece in its entirety but will call out two specific examples — how a company can think about improving CAC and how a company can think about improving margins — that do a fantastic job of illustrating the idea of, as Bezos talks about in his letter, "working backwards" from the intended impact you wish to have on the customer and also touch on Dearing's point about a good business equation being something that can be refactored in multiple ways.

Example Goal #1: Improve Customer Acquisition Cost — Two direct inputs the company can make to drive lower cost of acquisition are to improve the onboarding flow and lower the price. As we see from the images below, there are significant trade-offs to be made in adjusting both of these levers (in addition to the opportunity costs of, for example, product and engineering time spent building onboarding flows instead of other features). In the end, only by truly understanding every layer of the stack can a company make an informed decision on key strategic and tactical maneuvers.

Example Goal #2: Increase Margin — In the example given, two potential paths to driving higher margin are to increase AOV and to decrease packaging costs. Again, we see some sub-variables pointing in favor of each change and some that create a negative impact. There are also the qualitative costs to consider. For example, does less expensive packaging equal lower quality packaging, and what impact does that have on the "unboxing" experience and brand perception?

2. Business equations are deeply tied to value delivery (user engagement)

The justification for focusing so heavily on inputs in building a business equation is three fold:

They are controllable, as Jeff Bezos noted in his investor letter

They incentivize people to take on higher beta, more difficult tasks

They are immediately upstream of value delivery (which is expressed as user engagement)

It is this third notion — that inputs are immediately upstream of user engagement — that we will look at here.

True user engagement, as a16z's Jeff Jordan notes, is tough to "hack" in the same way that other metrics (user growth, for example) can be. This squares with Bill Gurley's point of view on the value of "liquidity quality", which he discussed in the context of Yelp on a recent episode of the Invest Like the Best podcast:

I've come up with this phrase I use internally that I made up — so one day, I'll have to write a definition of it — called Liquidity Quality. And I tell entrepreneurs, I care way more about Liquidity Quality than I do how broad you are. We can use venture dollars and growth playbooks to go broad if the fire's burning bright. So how do you get this liquidity quality high? Jeremy (Stoppelman from Yelp) doing things that don't scale at those nightclubs in San Francisco, and people being super passionate in their reviews, frequency being high, the quality of the experience, even though is in a very small area? And so I very frequently run into entrepreneurs who think they need to expand to 10 cities really quickly to raise their A or B or whatever. And I'm like, no. If you have like incredible unit economics and growth metrics in a single city, where it's obvious that your playbook is working and things are spinning and things are getting better, you basically have network effects. That's way more interesting.

But how does engagement actually express itself as part of a business equation?

Elliot Turner, an investor at RGA Investment Advisory recently shared a great deep presentation that addresses this question directly by identify why engagement is the "most important metric" within the broader business equation for both Paypal and Roku.

Business Equation Example: Paypal

Business Equation Example: Roku

3. Business equations map to accumulating advantage

Pulling it back to Benchmark, one of the foundational pillars of their approach is the emphasis placed on backing businesses with "increasing returns" business models. Can a company plug a highly engaged set of users into a compounding flywheel that gains momentum and leverage over time?

This is a close cousin to Keith Rabois' idea of accumulating advantage, which he lists as one of his primary investment criteria. Having an accumulating advantage means a business gets easier over time and usually indicates that a company has developed a defensible moat (recommended reading here and here).

The most effective business equations feed directly into a company’s advantage flywheel by serving as the push that gets the wheel spinning in the first place. Often, as we might expect, these flywheel accelerants come from engagement.

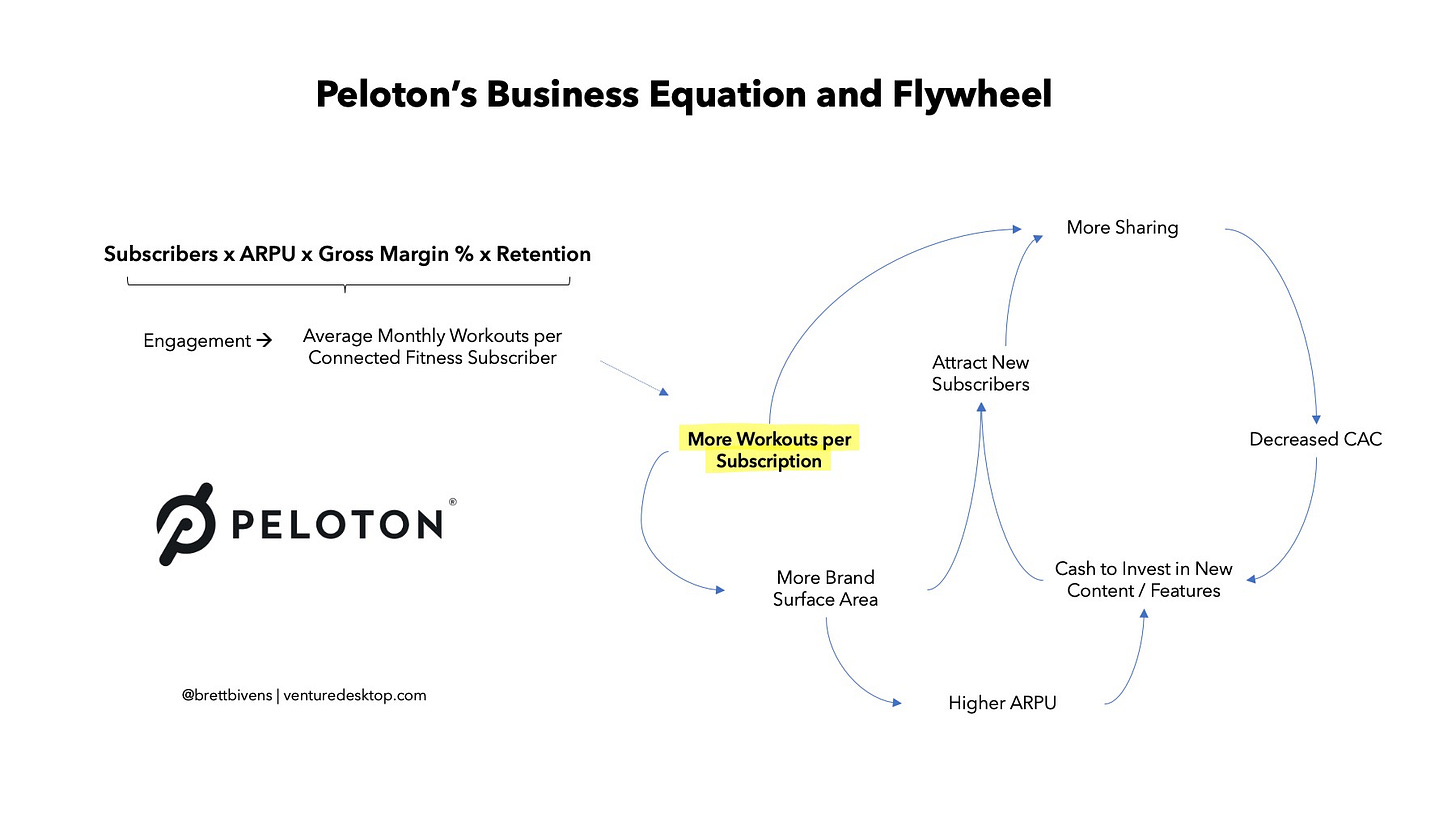

Peloton’s Business Equation

Peloton generates accumulating advantage via community. When the community gets stronger, the business gets easier and more profitable.

The lever — the key variable in the company’s business equation — that Peloton uses to understand the upstream factors impacting community and, by extension, growth and profitability, is average monthly workouts per connected fitness subscriber.

This figure features prominently in almost everything Peloton reports publicly and has been getting better and better over time, in lock step with impressive improvements in higher level outputs.

Why is this number so important to Peloton? Simply, it serves as the bridge between their business equation and their their flywheel.

Peloton’s business equation — or at least one variation of it — can be found in this post from Tren Griffin. As he notes, 5 key factors determine the long term unit economics of a business — ARPU, Gross Margin, CAC, Monthly Churn, and Discount Rate. I’ve modified this slightly below to, at least partially, incorporate broader user growth (subscribers) into the holistic equation.

We can double click into each of these to hone in on the sub-variables. For example, ARPU is made of spend across hardware, subscription, apparel, etc. At some level of granularity across each of these variables, we land at the “engagement layer” — Average Monthly Workouts per Connected Fitness Subscriber.

This, as you can see in the diagram below is the bridge and the accelerator factor in the company’s flywheel.

Word of mouth is one of Peloton’s largest sales channels and with each new workout completed, there is another opportunity for the user to share their experience with friends. Social media posts are probably the best example of this. This is a profitable acquisition channel which frees up additional cash to invest in new content formats and product features, expanding the addressable market for Peloton. Additional engagement also drives higher ARPU as users who complete more workouts are more likely to stick around, purchase Peloton apparel, or upgrade to additional subscription and hardware offerings.

“All models are wrong, but some are useful.”

If you search for Tweets related to business equations, it is common to find people asking for examples. Simple, it turns out, does not mean easy, both in formulating the equation for any given business or executing on it.

The reason for this, as we have seen across all of the different examples above, is that these models are not obvious and must be built from the ground up, sub-variable by sub-variable, to incorporate the complexities of each individual business. As with investing, operating a company is often best done bottoms up.

They also, because of the challenges of constructing them properly, become their own form of competitive advantage (“Process Power”) and are thus not something most companies want to shout about from the rooftops.

One of the great things about tackling a topic as complex as business equations is that the deeper you go, the more you feel there is to learn. That’s where I currently am with business equations.

In the near future, I expect to spend a lot more time trying to learn how to build business equations, deploy them, and analyze them because, to paraphrase George Box, though no business equation is perfect or all encompassing, in the hands of the right people they can be extremely powerful.

Thank you for reading! I’d love to discuss with you here in this thread on Twitter — disagreements, other ideas this prompts for you, etc.

Thoughtful and well written.

Wow this is an AMAZING piece. Thanks for sharing!