The Consumer Subscription Roll-Up Opportunity

On Match Group, Spotify, and building the Vista Equity of Consumer Subscription.

Led by companies like Netflix and Spotify and accelerated by shifting consumer preference, the Consumer Subscription Software (CSS) market is in the midst of an exciting period of growth that, per GP Bullhound, could see the average US consumer spending upwards of $100/year on digital subscription services by 2022 (up from around $10/year today).

With global distribution platforms, converging consumer tastes, more efficient business models, and emerging technologies breaking down many of the geographic barriers to building passionate communities, Consumer Subscription companies are being launched and scaled around the globe in nearly every consumer vertical imaginable. Again, from GP Bullhound:

Many companies in the segment have leveraged these factors to make serious progress without an over-reliance on external capital while those looking to use investment to fuel growth have found a very willing market. Within our portfolio, we've seen both capital strategies work well.

And while concerns about consumer retention and long term sustainability persist thanks, in part, to the same potential for shifting consumer needs that opened up the market in the first place, it is clear that a large number of new brands based around the Consumer Subscription model have real potential to become long term "franchises" that finally make the leap from single product companies to businesses offering a broader range of services and experiences to customers — either by going mass market and reaching a wider swath of consumers or by driving a larger share of wallet from their core user base.

As the market and business model continue trending towards maturity, it is inevitable we will see the capital stack mature alongside it — moving beyond large VC rounds focused on winning early market opportunities to systematic strategies where alpha is driven by operational excellence and global scale.

Private Equity for Consumer Subscription

In a previous post, I wrote about the opportunity for a firm to roll-up the At-Home Fitness market using L Catterton's activity in the space as a guide. What is worth pulling out of that post to set a baseline is what, beyond simply more mature market dynamics, creates a roll-up opportunity in the first place.

The strategy tends to work well when the group of companies being brought together are similar enough that they can benefit from shared, scaled out fixed “infrastructure” across core business functions but are different enough (end customer demographics, positioning/brand, geography, etc.) that they don’t encroach too aggressively on one another.

Quickly, I'll touch on three examples where different buyout models that could be employed effectively in the Consumer Subscription market and how we might think about when and where we'll see those strategies executed.

Multi-Brand Vertical Platform — Match

While I've noted throughout that the Consumer Subscription market — and the private equity opportunity related to it — is in its infancy, that's not entirely true. One company (Match Group in Dating) has been early to the opportunity in building a wholly owned portfolio of Consumer Subscription companies.

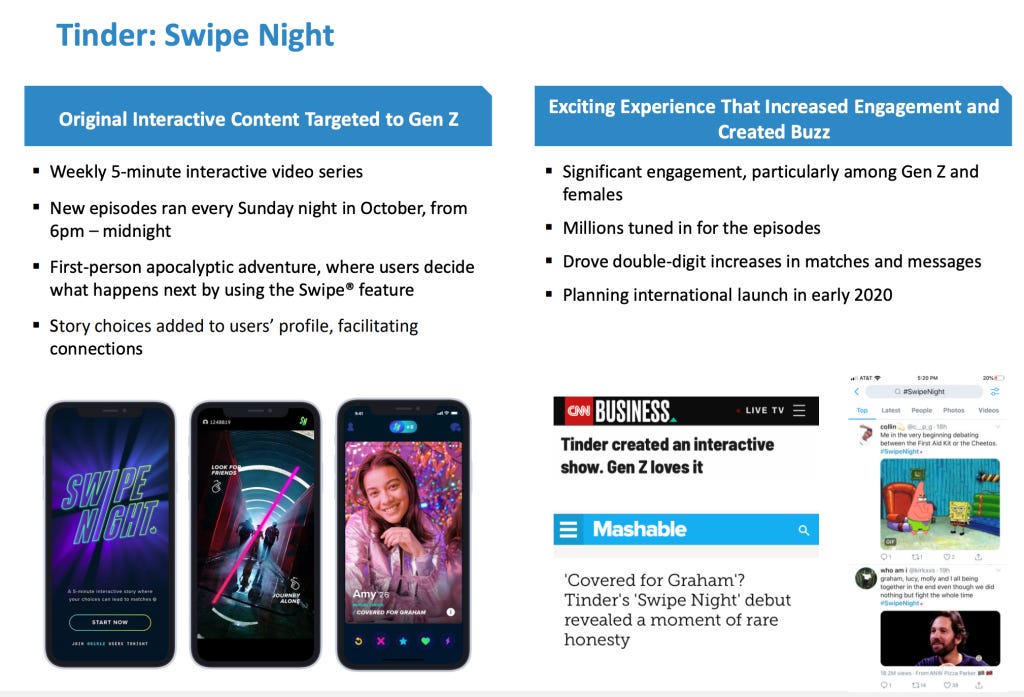

Match — who owns Tinder, Hinge, and OkCupid among many others — has spent the last 20 years building up a set of brands that cater to virtually every dating desire. The depth of expertise and data Match has developed via this strategy has enabled it to understand better than anyone else what features and experiences users across the portfolio are seeking (image 1 below) while its decentralization has given individual brands like Tinder (image 2) the ability to respond with agility and innovative ideas to meet their specific set of consumers where they are.

Where else might this strategy work? My guess is that it will first be employed in the fitness space. We've already seen precedent in the brick and mortar boutique world with firms like Xponential Fitness expanding category by category. L Catterton's aforementioned play in the equipment market is another indicator that this may be the next domino to fall.

Hub and Spoke — Spotify

If you follow me on Twitter, you've seen a lot from me recently about Spotify and the opportunity they have to expand beyond music to subscription offerings that more broadly address the "Spoken Word" market. By nature of owning a platform with significant consumer demand and laddering from music to their now large play in podcasts, Spotify is upstream (data-wise) of a lot of different Consumer Subscription expansion opportunities that it can capture via M&A and new internally developed products.

This is what I call the "Hub and Spoke" model — leverage a core subscription user base and then upsell additional offerings to gain a larger share of wallet from your core customers. Until recently, this option seemed out of reach for most Consumer Subscription companies struggling to simply generate enough demand to support a single product at scale. This is changing.

And while Spotify is, of course, not a private equity player, the opportunity for a similar model exists in other categories (religion is one that sticks out to me, but there are others).

Vertical Agnostic Operational Excellence — The Thoma Bravo / Vista of Consumer Subscription

This final model is one that, to my knowledge, has not yet been deployed in the Consumer Subscription space but thanks to more experienced operators, better long term data and benchmarks, and a more mature corporate M&A market, the pure-play Consumer Subscription Buyout firm — built on operational excellence playbooks, top-tier talent networks, and a long term commitment to the business model in the mold of ThomaBravo or Vista Equity seems on the horizon.

Building out this model to start would not take a massive capital investment as the firm going after the opportunity would likely not be vying to compete to buy billion dollar companies like Calm or Blinkist. Instead, the strategy would be best focused on vertical opportunities in companies that are either:

Largely founder owned via capital efficient growth (i.e. staying off the VC treadmill) where the initial product is reaching its natural growth limit and a buyout can provide founder liquidity and allow for a capital and management injection more focused on leveraging a strong brand to expand to new categories / geographies that couldn't have been reached via organic growth.

Companies overly reliant on VC funding to date without clear paths to large growth rounds or $1b+ outcomes but where a more rigid operational approach could yield a more sustainable business that — within a 3-5 year period — can be turned into an attractive asset for a corporate buyer.

While we may be a couple years out from this strategy being employed at an kind of real scale — as the market remains so nascent that most categories are still very much up in the air and long term category structures are far from being in place — it is something I will be watching closely.

If you enjoyed this post, I’d love to have you share it, subscribe to my newsletter, and reach out (brett.bivens@gmail.com)