The pandemic has given rise to an interesting phenomenon I’ve taken to calling “Clampetition”. Essentially, companies are using the completely disjointed economic situation to make classy moves that double as smart customer retention or acquisition tactics.

Most of these moves are small and straightforward — free access to a previously paid app for a 30 day period in areas where new customer acquisition may have been a challenge anyways.

Others, like Zoom upgrading its education users, have been done to capitalize on an unexpected surge in demand and attempt to lock users into use cases and behaviors that may persist well beyond the time of quarantine.

And yet others, like Grubhub announcing a temporary suspension of collecting up to $100m in commission payments from independent restaurants seem pointed directly at the weaknesses of certain competitors. Note the runway figures in the chart below.

This week, Spotify and Square (Cash App) announced one of the largest “Clampetitive” partnerships we have seen thus far. From Spotify:

We also felt we could uniquely help by providing the global reach of Spotify to artists who are fundraising during this challenging time — to help them get the word out to fans, many of whom visit them on Spotify every day. And we've been really inspired by fans that want to help the artists they love and have been making direct donations.

That’s why, today, Spotify for Artists is launching a new feature: the Artist Fundraising Pick. Just like artists can select any piece of music to highlight on their profile as an Artist’s Pick, they can now highlight a fundraising destination (in addition to their Artist’s Pick).

This, even just at surface level, a smart move for Spotify. Artists and the broader ecosystem that surrounds them are hurting right now, as this Bloomberg piece explains well, and any additional money in the door makes a huge difference:

Touring has become the primary source of income for most musicians, many of whom have opted to stage live concerts from home and stream them over the internet using Instagram, Twitch and YouTube. Some have charged tickets for shows on sites like Stageit. But most artists are making a fraction of what they once made, while concert promoters, sound technicians, roadies, agents and managers are struggling to make any money at all.

On top of that, Square is a company that deeply understands music and culture. Dan Runcie at Trapital wrote a great piece on this:

In 2018 it teamed up with Travis Scott and Lil’ B. In December, it got together with Snoop Dogg. Each of them used the app to give away money. The company acquired customers through the rappers’ social media followings at an extremely low cost. Free money is an easy sell, and it doesn’t take that many customers to justify the cost.

Spotify’s Ladder

Spotify’s position in the competitive landscape has always been a problem. On one side, they are faced with powerful suppliers in the record labels who extract a pound of flesh from every bit of revenue that flows through Spotify’s platform — even podcastsing and certain advertising revenue that has nothing to do with the labels.

One the other side, they are competing with some of the largest and most well resourced companies on the planet who see music streaming as a complement to their core business that they can commoditize:

Scale solves some of the issues related to this — but getting to requisite music streaming scale in the face of competition from platform players like Apple, Amazon, Google, Tencent, and Bytedance is likely an insurmountable hurdle. All of these companies can afford to engage in price cutting and are happy to run their music businesses unprofitably for a long time to support larger and more attractive core businesses (AirPods, TikTok, etc.).

In short, these companies see their digital music businesses as a complement to their primary raison d'être and are aggressively seeking to commoditize it. Despite the scale of their investments in the space, winning on the content and streaming side of the audio market will always remain a nice to have (to varying degrees) for these platform players. For Spotify, it is existential.

There are real structural justifications for Spotify slow playing the opportunities they have in both social features and marketplace functionality — as Victor Patru noted, adding too many social features would risk undermining the company's bargaining power with record labels. The same can probably be said for trying to go direct to artists with additional monetization efforts.

In short, the company has been backed into a corner that it can’t just innovate its way out of.

The Reset

The pandemic situation has caused a hard reset for many industries and activities and, to take a positive perspective, provides a blank slate to reconsider the way many markets and economic relationships are structured.

For example, the Paris region announced it will spend €300 million on a 650-kilometer secured cycle network beginning May 11 in an attempt to redesign the city to be less dependent on cars.

It is also common to hear people talk about the pandemic simply pulling forward changes that were already in flight. Healthcare, as I wrote a bit about on Telegram, is a massive part of the economy being pulled apart in real time.

Spotify benefits from both of these effects, and has a once-in-a-company-lifetime opportunity to capitalize on them to create long term value for itself and the artists that depend on its platform.

The partnership with Cash App is a microcosm for the position the company finds itself in.

Spotify is the company with the greatest incentive and ability to help artists get through this period. Competitors like Apple and Amazon (rightly) have their focus on different problems and impact areas and labels, who don’t have any additional channels to support artists through this crisis, have no grounds to criticize the move (it would be terrible PR, for one).

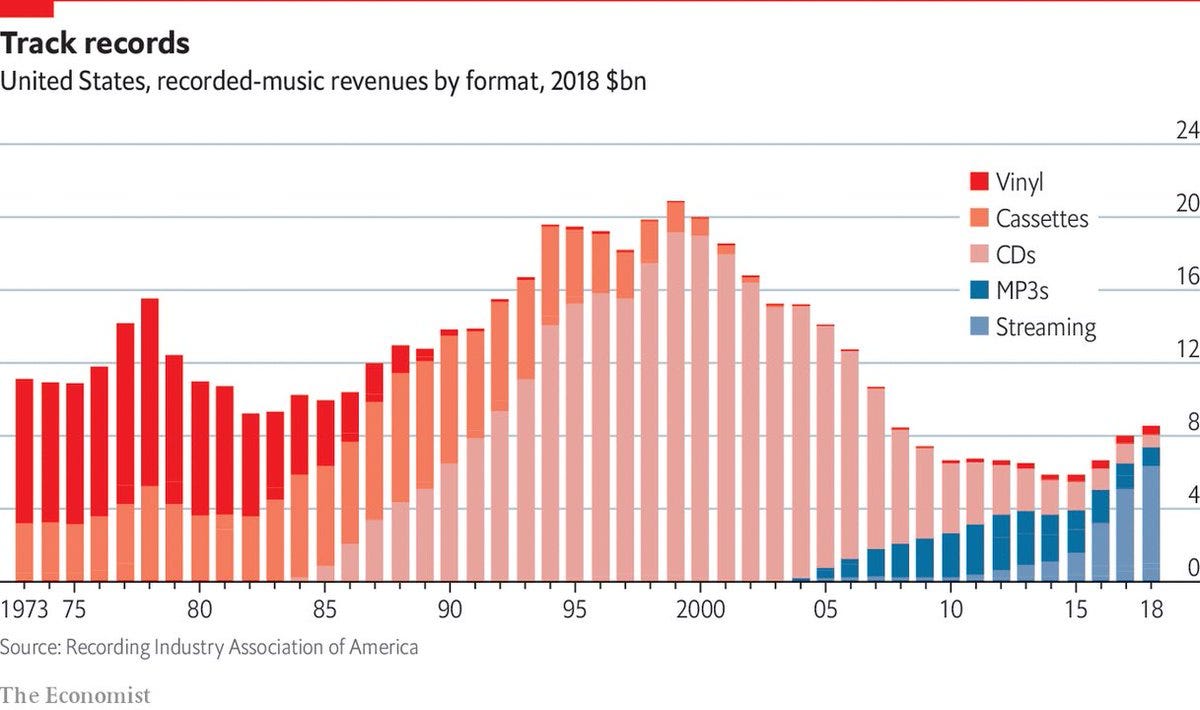

Much of the ire Spotify draws from industry observers for not paying artists enough, is really just a reflection of heavy handedness from the labels (people making those arguments also tend to ignore charts like the one below) and the success of this partnership with Square has the potential to make that even more obvious.

The direct connection "marketplace" they've established between artists and their fans pulls forward the disintermediation of the labels and shifts the influence in Spotify's favor. I wouldn't be surprised to see a newly emboldened Spotify roll out something to help artists host live shows or connect for Q&A type interactions soon as well.

Spotify, for once, has carte blanche to innovate and their progress in that direction over the next few quarters will be a good indication of their prospects for the next decade.

Disclosure: I own shares of both Spotify and Square. This is definitely not investment advice…

Posts about Spotify tend to warrant a lot of differing opinions. If you have one of those opinions, I’d love to discuss with you here in this thread on Twitter — disagreements, other ideas this prompts for you, etc.

Venture Desktop on Telegram

Over the course of the last week, I shared over 20 different links, wrote a few quick articles and had 85 new people join the Venture Desktop Telegram channel. I’d love to have you come check it out!

Here are a few of the things I wrote there or links I shared that are worth checking out:

The Bifurcation of Healthcare - I also laid the crux of the case for the unbundling of healthcare out in this Tweet and graphic:

What happened to the future? (Founders Fund)

Shrink a Market! (Josh Kopelman, First Round Capital)