The Age of Precision Wellness

Ushering in the Metaverse of Health.

We are living through a transformational shift in consumer demand that has been well underway for over a decade.

From: One-size fits all brands, media, and retailers leveraging scale for mass market reach.

To: Consumer-led innovation, catalyzed by "divine discontent", that forces companies to compete by redefining and personalizing the customer experience in real time to dynamically bundle entirely new systems of meaning for consumers.

When the paradigm is shifting, speed becomes a competitive advantage.

Companies capable of rapidly adjusting incentives, distribution models, and product features to meet consumers where they are have an edge they can compound over the long term.

Nowhere are the effects of this paradigm shift more pronounced than in the world of consumer wellness.

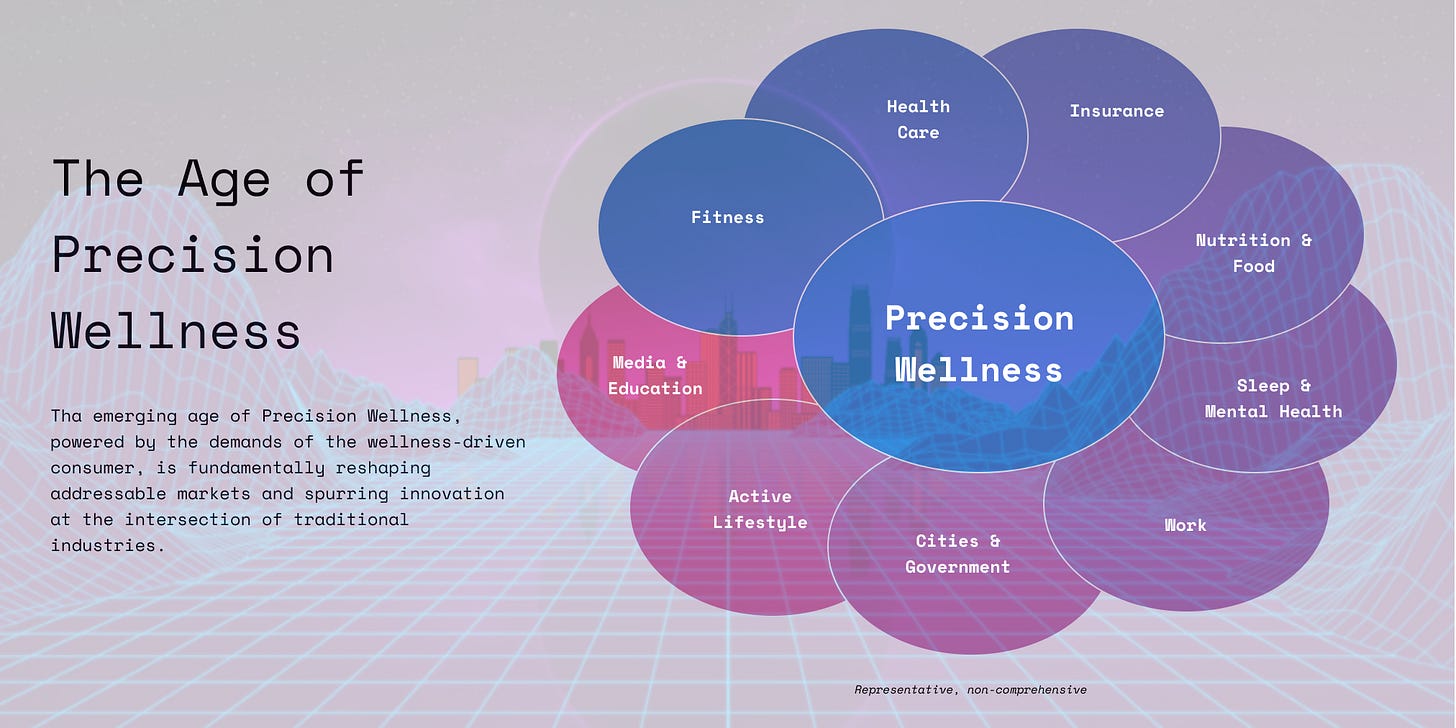

The emerging age of Precision Wellness, powered by the demands of the wellness-driven consumer, is fundamentally reshaping addressable markets, spurring innovation at the intersection of traditional industries, and creating massive opportunities for emerging companies building hyperpersonlized technology, communities, and experiences that improve human health, happiness, and opportunity.

The wellness-driven consumer is more informed, more principled, and in search of more lifestyle control than ever before and the impact this is having on the global economy is already well underway.

Wellness-related spend now accounts for over 5% of global economic activity, is growing at almost 2x the rate of the broader economy, and is increasingly integrated with every aspect of our day to day experience.

With global distribution platforms, more efficient business models, and emerging technologies breaking down many of the geographic barriers to reaching customers, companies are being built and scaled around the world to capture value from this dynamic market.

The Impact Gap

Despite increasing consumer spend and attention along with an incredible amount of capital poured into companies building for the wellness-driven consumer, there remains a massive impact gap.

64% of Americans want to lower healthcare costs but 80% don’t even meet minimum exercise requirements. This inactivity cost the US economy $28b in medical expenses and lost productivity.

Over 250 million people suffer from depression and anxiety and few have the holistic support to manage their condition effectively across work and personal contexts.

37.2 million people in the United States live in food insecure households.

In the United States, 19% of young people aged 2 to 19 years and 40% of adults have obesity, which puts them at risk for heart disease, type 2 diabetes, and cancer. It is estimated that obesity costs the US healthcare system $147 billion a year.

Few people are equipped with the health literacy required to navigate the healthcare system, engage in a healthy lifestyle, and support friends and family seeking to do the same.

Statistics like these are simply the tip of the iceberg. As frustrating as it is to observe skyrocketing costs, stagnating healthspan, and uneven access, there is reason to remain optimistic — where there is a gap between attention and effectiveness, there is an opportunity for innovation.

I’d love to discuss this post with you on Twitter and hear about interesting things you have seen in the world of consumer wellness. Likes and retweets also help if you’re enjoying the post. 😉

The Rise of Precision Wellness

Understanding why this impact gap persists and how it might close requires us to take a look back at how the market has unfolded over the last decade and where it is headed over the next 10+ years.

To do this, we will apply a physical activity-centric lens to the market. Why?

It is large, growing, and impactful — Even small changes to a consumer's fitness and activity regimen can have a dramatic impact on health care costs, healthspan, and risk of disease and illness. Consumers have proven a willingness to spend to the tune of $100B+ per year in fitness, and multiples of that pursuing active lifestyles.

It exists largely outside of the health care and regulatory systems — Consumers are accustomed to paying out of pocket for physical activity-related products and services and bringing new solutions to market rarely requires FDA or other regulatory approval.

It represents the best wedge to scale into other categories and behaviors— Companies that build engaging physical activity experiences own valuable and hard to attain chunks of daily consumer attention and create a channel for expansion into areas like sleep, nutrition, and direct to consumer healthcare.

Using this perspective, I believe we can separate the trajectory of the market into three periods.

Generation I — Quantified Self and Boutique Wellness

2010 - 2015

The first generation of digital fitness and activity companies were largely focused on tracking what we were doing and required significant motivation and legwork from the consumer (quantified self obsessives) to drive any real value.

Counting our steps, calories, and miles yielded little in the way of actionable insight, and perhaps most importantly as Under Armour, Adidas, and many other corporates found out after making splashy acquisitions, provided no strong retention hook to keep users coming back over time.

Concurrently, SoulCycle and others following in its footsteps expanded rapidly during this period. While these companies nailed motivation and retention, they offered little in the way of digital engagement, remained accessible only to high income consumers, and have not reached internet scale.

Generation II — Content & Community

2015 - 2020

What Peloton understood with high quality videos featuring celebrity-like coaches and its SaaS plus a Box business model, or Zwift understood with its immersive multiplayer cycling game, or Strava understood with its vertical community focused on tapping the competitive nature of every athlete, is that without a strong reason for users to keep coming back to the product, value is capped. This is borne out in the valuations we see today relative to the companies that came before.

These insights, combined with ubiquitous mobile penetration and global distribution platforms (iOS/Android) have also opened up the international opportunity for companies based all around the world — Keep in China, Cure.Fit in India, Gympass in Brazil, and Freeletics in Germany.

What's more, all of the leaders from this generation remain independent and have the potential to grow massively as we move into the next decade and the next era of the market.

Generation III — Precision Wellness

About a decade ago, Marc Andreessen coined the term “software is eating the world” to frame the paradigm shift occurring in the global economy. A similarly massive opportunity exists for Precision Wellness companies aiming to take a major bite out of the Digital Health market.

With passive and more accurate monitoring paired with smarter algorithms employed to drive precision treatment and nutrition along with the ability to use AI to provide a 1:1 experience at global scale, we will see companies start to cut significantly into the $68b of global productivity loss directly attributable to lack of exercise, help the 163m Europeans who experienced activity limiting musculoskeletal pain in the last week (*raises hand* 🤕), and enable equitable access to solutions that positively impact consumer health and happiness.

The Precision Wellness opportunity is as big as it gets, and companies like Apple, Google, and Amazon know internet scale opportunities when they see them. Each of these three companies have approached the health and wellness market aggressively and in ways that leverage their respective strengths.

Apple building HealthOS via the Health App and Apple Watch and realizing Tim Cook's ambitious mission of making health Apple's greatest contribution to mankind.

Google furthering its Ambient Computing vision by acquiring Fitbit (and the data from almost 30 million users) to build its own integrated family of hardware and accelerate the nascent market.

Amazon expanding its "Everything Store" mantra to health, ambitiously tackling the market end to end — from redefining the pharmacy through its Pillpack acquisition to its healthcare joint venture with Berkshire Hathaway and JPMorgan Chase to the opportunity to bundle health and wellness-related offerings into Prime.

Together with emerging companies featuring deep technology at the core (Whoop, Tonal, Pivot, Oura, and Future.Fit are examples) and the market leaders mentioned in the section above, there has never been more attention or capital aimed at reshaping consumer health and wellness.

Onward to the Metaverse (of Health)

Every one of the companies highlighted above is competing to go both horizontal by serving consumers across categories and vertical by injecting themselves at the rock, sand, and water levels of consumer attention for a given category.

This competition creates "liquidity" for consumers seeking solutions and brings us closer to a holistic health and wellness experience that is more immersive, collaborative, responsive, contextual, and accessible.

In effect, we are racing towards the Metaverse of Health.

If you are not familiar with the concept of the Metaverse, I recommend reading this analysis by Matthew Ball. As you will see there and in other perspectives, the Metaverse tends to be very closely tied today to gaming.

However, as Ball notes in his piece, the idea of it being a successor to the internet means that "the Metaverse has become the newest macro-goal for many of the world’s tech giants". Thus, any market opportunity central to the strategies of the world’s tech giants — like health and wellness — is de facto on the Metaverse roadmap.

In his piece, Ball lists seven key attributes of the Metaverse. As I will describe below, the foundations underlying the emergence of the Metaverse are also critical elements of what will allow companies to more effectively meet the wellness needs of the global marketplace and propel us into a healthier future.

With the centrality of both health and the Metaverse to the long term strategies of all of the tech giants and the same enabling technologies driving innovation in both areas, these two roads are merging quickly.

Be persistent

Highly accurate, passive biometric tracking to fill in the longitudinal data gaps that exist for consumers between interactions with health and wellness support professionals.Be synchronous

Real time access to care providers, coaches, and community to enable highly contextual communication and drive more informed decision-making.Have no real cap to concurrent participations with an individual sense of “presence”

Fully immersive health & wellness experiences available to the mass market that are both hyper-personalized and highly collaborative.Be a fully functioning economy

Development of digital labor and support access marketplaces featuring transparent costs and seamless transactions.Be an experience that spans both the digital and physical worlds, private and public networks/experiences, and open and closed platforms

Augmenting physical activity (working out, shopping, eating, working) with a digital support infrastructure and smarter environmental and contextual sensing in our day to day environment.Offer unprecedented interoperability of data, assets, content, and experiences

Seamless identity solutions, dynamic health records incorporating persistent data gathering, holistic support across personal and professional context with requisite privacy considerations.Be populated by “content” and “experiences” created and operated by an incredibly wide range of contributors

Consumer to consumer collaboration fostering community and driving increased engagement and retention, expanding the market for who is empowered to be a health and wellness creator or expert.

These descriptions — each opening up billions of dollars of market opportunity — represent the first order impacts of the onset of Precision Wellness. The second order effects waiting around the corner are harder to identify a priori but have the potential to create orders of magnitude more positive impact over time.

In thinking about this opportunity, "over time" is important to keep top of mind. The Metaverse of Health, just like the broader Metaverse, isn't a fully immersive world we suddenly arrive in one day. Instead, it is likely that over the next decade we will primarily experience it as an emergent layer on top of the physical world that dynamically builds upon itself over time — an improved extension of the digital health and wellness experiences on offer today that, while not all encompassing, become increasingly present.

The opportunities to create value in the coming Metaverse of Health are endless, but so are the risks and societal downsides.

Is it possible to create immersive, personalized, always-on experiences that make use healthier while at the same time respecting privacy?

How do we avoid compounding the racial, gender, and socio economic biases that exist in the healthcare system and wellness market today and create a truly inclusive generation of better, cheaper faster solutions?

Can we establish the right type of educational infrastructure (that we've failed at miserably thus far) and create consumer literacy across both health and technology?

The big tech companies have a head start in the race to win the Metaverse of Health — millions of users, substantial R&D budgets, top down commitment, and incredible solutions already in the market. But their collective track record on the more complex societal issues tied to Precision Wellness are, to put it generously, checkered.

To paraphrase William Gibson, the future of Precision Wellness is already here, but only on iPhones, wrists, and apartment floors located in the world's most expensive zip codes.

Reaching the Metaverse of Health requires broader distribution made possible by a more inclusive form of progress. Customer-centric early stage companies unburdened by mixed incentives or misaligned business models have a unique opportunity to pull this healthier future forward.

Read More and Connect

If you liked this post, I’ve written a few other related pieces you might enjoy as well.

If you are building or investing in anything in the world of Precision Wellness, I would love to connect and discuss with you on Twitter.

Disclosure: The firm I work for, TechNexus, is a small investor in Tonal along with a number of other early stage health and wellness companies. I also personally own shares of Peloton. None of this is investment advice.

thanks for sharing your info with us.

https://naturesblendshop.com/product/zinc-lozenges-with-a-c-bee-propolis-cherry-flavor/