Structural Shifts

My podcast discussion with Ben Robinson of Aperture

Late last year, I committed to more actively seek out opportunities to “learn in public”. That meant getting more active on Twitter, starting Venture Desktop, and joining public conversations (podcasts, talks, etc.) when the opportunity arose.

This week, I had the chance to jump onto the Structural Shifts podcast run by Aperture, a very interesting strategy firm based in Geneva, to pull together a bunch of the ideas and concepts I’ve been writing about over the last six months.

You can listen to the podcast on Apple Podcasts, Spotify, or wherever else you get your audio fix. I have also embedded the YouTube recording here.

Below, I’ve pulled out a few quotes from the transcript that draw on many of the things I have written about over the last six months of Venture Desktop.

Audio as a wedge for mass market VR

Top down vs. bottoms up investing

Business Model Leverage

Evaluating company culture

Accumulated accidents and the carte blanche innovation moment we are currently in.

Hope you enjoy!

Ambient Audio and the Metaverse

I think that most people look to gaming as the first path for immersive social media. And they’re definitely not wrong about that. I mean, we’re seeing that play out in real time with things like Fortnite and these massive games that have created virtual universes, but if we think about the things that create immersive, kind of these metaverse-like experiences, even on a partial basis, and you have things like persistent worlds and synchronous collaboration and communication and the ability for the platform to be populated by content that’s created by a wide range of contributors, and even interoperability across platforms — I think all of those things work well with audio. And so, I think that a lot of people might actually get their first onboarding into VR-like experiences through audio-first experiences.

Read Spotify: The Ambient Media Company →

Business Model Leverage

The way that I think about ‘business model leverage’ is you build up your core business on what might be considered a low margin business that presents opportunities to then scale in a way that helps you expand the margin or sets you up to at least scale in a way that helps you maintain margin. And so, when I think of Spotify with […] by owning the consumer demand via the lower margin streaming business, they have the opportunity to expand into those areas. Lululemon, as I talked about, is a similar company — they have a high-margin business, to begin with, relative to peers, but because of the fact that they’ve invested in digital, they’ve invested in all of these community-level features, they also have additional areas to grow that help them maintain their high-margin status.

Read Business Model Leverage →

Evaluating Company Culture

Company culture is the bridge between theory and action. It is the operationalization of a company’s values and it expresses itself as a set of frameworks that a company uses to make decisions under uncertainty.

Bottoms Up Investing

The (venture capital) investment thesis […], surely becomes sort of a marketing vehicle, a way for you to tell the market who you are and what you stand for and how you think. The challenge comes when you start to overly believe your own view of the future and close your mind off to the ideas that founders are coming to the table with and some of the emergent opportunities that develop in the ecosystem. And that’s really where the friction comes in between bottom-up investing and being overly thematic.

There’s a new paradigm — places where there’s a significant gap between engagement and monetization, where companies have been positively impacted by shifting spatial economics, where there is network effect developing or positional scarcity developing. But, the market hasn’t quite caught up to that or understood that yet.

Read The Merits of Bottoms Up Investing →

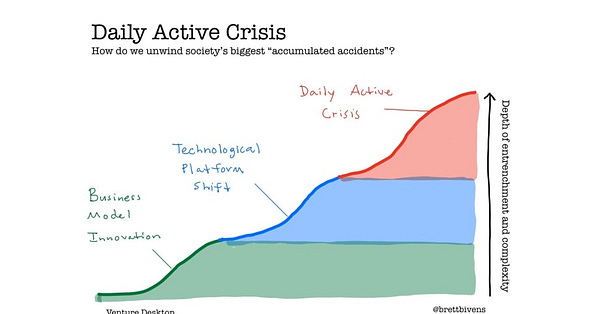

Accumulated Accidents

A really interesting term that I learned about a couple of months ago, called ‘accumulated accidents’, […] and it basically prompts us to say about different societal behaviors or institutions, whether this is actually representative of an ideal expression of society, or whether is built upon a series of accidents that can actually be unwound in the right circumstances. And, really, for lack of a better term, it’s creative destruction. It’s how new innovation comes to market. And in a lot of cases, you can unwind some of these accidents via a better business model or via better technology but some of the really, really big things, some of the things that we’ve really screwed up in the past that have just accumulated on themselves and where incumbent interests have become extremely entrenched and difficult to pull away, I think that’s what this crisis is giving us — an opportunity to rethink and reset with.

“Clampetition” and Innovation Carte Blanche

The pandemic has given a lot of companies this carte blanche to do innovative stuff that they may have not had the boldness to do before. The way that I think about this term, ‘clampetition’, it’s a word that just joins together competition and classiness, which is essentially companies using this totally disjointed economic situation to make moves that are classy in terms of helping their customers or helping their suppliers, but also double as these smart customer retention or acquisition tactics.