Patient Innovation, Co-opetition, and Competitive Advantage

Why Spotify is a bellwether for broader shifts in economic power and consumer demand

Hey from Paris! 👋

I’ve started going back and recording audio versions of the essays and analyses I’ve written over the last few months in case you prefer to consume that way (I do). I expect I will do this for most of what I write going forward. You can find recent recordings below:

Todays Audio Edition — Patient Innovation, Co-opetition, and Competitive Advantage

Previous Audio Edition — The Merits of Bottoms Up Investing

If you are so inclined, you can also subscribe to get updates in Spotify, Apple Podcasts, or wherever you get your podcasts.

Some companies are bellwethers for shifts in economic power and consumer demand taking place well beyond the core markets or value chains they are most associated with.

This, even more than my personal interest as a consumer and early stage investor in audio and media, is what draws me to Spotify. Specifically, there are three intertwining elements I find so fascinating about Spotify and the company’s strategic considerations.

Spotify embodies the core challenge faced by the European technology ecosystem more than any other company.

The company’s fraught web of co-opetition composed of suppliers, investors, and distributors is emblematic of our shift away from an industry centric view of competition to one of “Economic Oceans”.

These competitive dynamics have forced Spotify to innovate “patiently”, a posture that may become more common as the operational pendulum shifts away from the “move fast and break things” ethos of the last 15 years.

Below, I go deeper into these three bellwether traits and, through a video interview and Twitter thread that I have embedded below, tie them to how they are impacting Spotify’s ability to climb the “Ambient Media” ladder.

I’d love to discuss this post with you on Twitter — where do we agree or disagree, any new ideas this prompts for you, etc.

Spotify and European Tech

I moved to Europe two years ago after following the venture ecosystem here closely for many years. Despite ongoing challenges with fragmentation, the market has found its footing in a major way. In the last five years, venture capital invested in Europe grew 124% as investors from across the world recognized the quality of talent and the global ambitions possessed founders starting companies across the continent.

Europe is still, however, stuck in the middle between the global power of the American giants and the seemingly unrelenting rise of the Chinese tech platforms. Spotify is a microcosm of this challenge and their ability to execute in the face of mounting pressure from both directions over the next decade will be a barometer for Europe’s ability to compete.

Whether it is Apple (iPhone and increasingly AirPods), Amazon (Alexa), Google (Search), Bytedance (TikTok), or Tencent (games and social products), each of the company’s main competitors view their music and audio streaming businesses as complements to a more attractive core businesses. Spotify bears the brunt of this as these companies all seek to aggressively commoditize complementary adjacencies.

Co-opetition and Economic Oceans

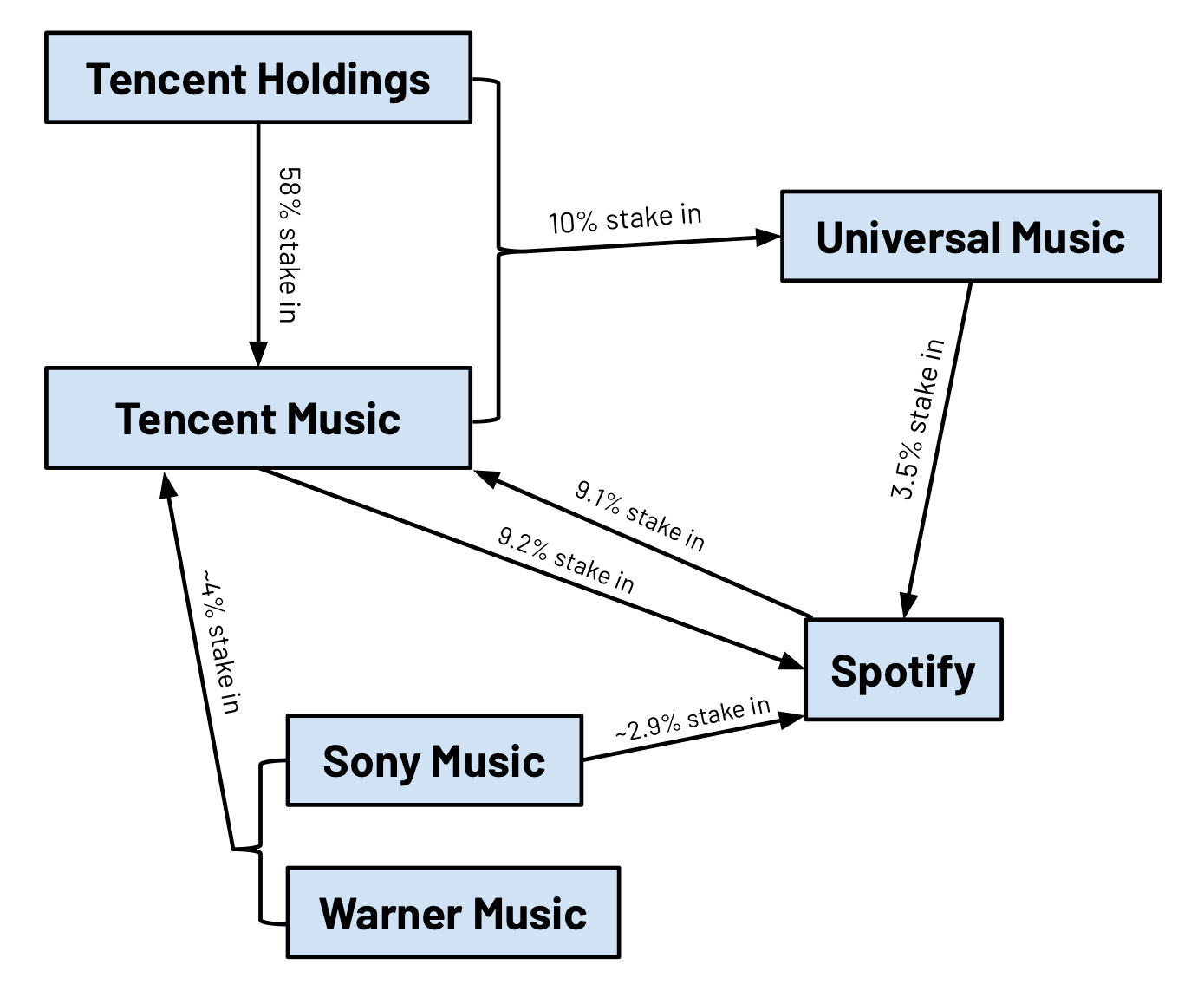

It is hard to think of another company who is locked in deeper co-opetition with its suppliers and distributors than Spotify. One one side, a twisted web of ownership with record labels and Tencent Music. On the other size, a reliance on competitor owned platforms like the App Store and Play Store for distribution.

Image via Cherie Hu who writes the great Water and Music

This structural conflict has forced the company to be very measured in the way it releases new product features or attacks new business models.

The blurring line between partnership and competition will become commonplace for almost every company moving forward as our notion of who occupies a given value chain shifts from an industry centric view to one that considers the much more dynamic notion of “Economic Oceans”:

These Economic Oceans — Work, Well-Being, Cities, Media, Commerce, and Industry — aren't individual industries, verticals, or trends and aren't defined by specific technologies or business models.

Instead, they are best viewed as massive pools of attention and economic value that are, to draw back to the ocean analogy, deep, complex, overlapping, and (as we are currently witnessing in real time) often quite fragile. And while the categorization is not comprehensive, we can observe that many of the most impactful companies built over the last decade — Square, Uber, Peloton, even Zoom — have been built at the intersection (and with an innate understanding) of two or three of these Economic Oceans.

Coming back to Spotify, it is clear that it can’t compete with the scale and built-in distribution of competitors like Apple Music and YouTube Music and is limited by the systemic vice grip the record labels have on the industry. Thus, the company has been forced to seek another form of edge.

Patient Innovation & Time Arbitrage

This edge, it seems, is time arbitrage. More specifically, the company has grown comfortable with innovating patiently in a way that cuts against the gospel of “move fast and break things”.

One of the strongest sources of competitive advantage for a company is a differing time horizon.

It is also one of the hardest to attain because operating with a longer term outlook than competitors tends to start off almost entirely behavioral. With the number of decisions made across a global organization every day, competitive advantage derived from a long term perspective can unravel quickly unless a company develops both a cultural and structural orientation towards the long term that competitors can not.

We have touched on the structural elements of Spotify’s time arbitrage in the two prior sections. The flip side of facing down competitors seeking to commoditize its core value proposition is that Spotify has the benefit of focus. This focus has translated into a differentiated user experience that has allowed them to incrementally shift the leverage in their various co-opetive relationships over time.

Sustaining the structural and cultural time arbitrage advantage depends on strong leadership capable of embedding an almost stoic disposition in the culture, never accepting short term gains that comes at the expense of long term advantage.

From my perspective as a 100% outsider to the company, Spotify’s culture (and thus, its strategy) seems fully geared towards this type of patient innovation. This is evident in the strategic decisions the company has made in recent years and shines through in interviews Daniel Ek and other top executives.

This measured patience isn’t just a nice to have for Spotify, it is existential — and the company understands that.

There is a variation of Keynes’ “the market can remain irrational longer than you can remain solvent” at play here. It is entirely possible that the long term game being played by Spotify gets compromised because its competition is simply too powerful, too flush with cash, and operating with more unencumbered business models.

To use one example, Tencent Music (TME) and SirusXM (SIRI), while formidable, are hardly the biggest competitive threats to Spotify. But as seen in the chart below, they both operate with what seem to be much more sustainable business models — enabled by fewer competitive pressures — than Spotify.

Even with these uphill battles in mind, my sense (as I go deeper into below) is that Spotify is making the right moves as they look to climb the “Ambient Media” ladder and move from weaker form behavioral competitive advantage to something resembling true platform power.

A Spotify Interview

I recently jumped on with Dave Kemp and Collin Borns at Voicing Tree Live to pull together all of my thoughts about Spotify. It was a fun discussion and I’ve embedded that video here.

A Spotify Meta-Thread

Continuing the discussion from above, I pulled all of my thoughts on Spotify into a thread on Twitter that frames Spotify’s strategic ladder and how their patience is starting to pay off.

We are entering the Age of Ambient Media and Spotify's recent moves show they want to be the central player in this new paradigm. This is evident in recent launched like Harry Potter at home, video podcasts, and Artist Fundraising Pick in partnership with Cash App.

First, it is important to understand what Ambient Media is and why it matters — both generally and for Spotify.

The rise of AirPods, smart speakers, and other wearable devices may not signal the onset of a true platform shift, but it undoubtedly represents a transformational evolution in the way we will consume media — and this emerging paradigm of distributed, "eyes up" device interaction directly benefits audio more than other content categories.

An overlooked bull case for Spotify has always been their "Business Model Leverage". Spotify's low margin streaming business sets up huge opportunities in adjacent areas and means they may be a future high margin company hiding in plain sight.

Spotify's strong Business Model Leverage means that over time they have the opportunity to be the first "negative churn" consumer subscription company through features that improve retention and actually create expansion recurring revenue channels.

Spotify has always been upstream data-wise of new offerings to create this negative churn dynamic. They are starting to take advantage of this positioning through the aforementioned Harry Potter initiative (ebooks) as well as their work in health and wellness.

A defining feature of Ambient Media is that it is contextual — we have different consumption preferences while walking than while sitting on the couch. New audio categories partially bridge the contextual gap but doing video right would be a major leap.

There is one catch — this all hinges on Spotify reconfiguring its supplier relationships by shifting leverage with labels and eventually building more direct channels to creators. Enter: Artist Fundraising Pick, in partnership with Cash App.

As I’ve said throughout this piece, Spotify is making the right moves and catching some fortunate breaks, but another feature of their "ladder" is the Boss-level foe they need to survive at every rung.

First the labels, then Apple/Amazon/Google, then TikTok. A competition slide like this leaves no question of what they are up against.

If you made it this far, I’m sure you either loved or hated the analysis :-)

It would be great to discuss this with you in this thread on Twitter or have you share Venture Desktop!